Why yet another page on Berkshire Hathaway? Discovering Berkshire Hathaway became my anchor in the storm of economic uncertainty. The duo, Warren Buffett and Charlie Munger, guided my shift from risky investments to a focus on capital preservation. Dissatisfied with traditional funds, I found Berkshire's stability and unique philosophy irresistible. Delving into their subsidiaries, I created brk-b.com to share hidden insights. It's a personal journey beyond the surface, a quest for understanding in the midst of financial chaos. Join me in exploring Berkshire's stability, demystifying complexities, and embracing a resource that goes beyond conventional click-bait financial news. I sincerely hope this site could also be your gateway to the world of Berkshire Hathaway.

Berkshire Hathaway

For many years, I have been in pursuit of a safe haven to protect my hard earned assets from the volatility and uncertainty wrought by the expansive monetary policies of central banks such as the Federal Reserve (FED) 1 and the European Central Bank (ECB) 2. In an era characterized by reckless money printing, the primary concern for the prudent investor might have shifted from seeking maximum returns to the more conservative goal of preserving value over time. Especially in this setting, Berkshire Hathaway emerges as a bastion of financial stability and a testament to the value of risk aversion.

The Quest for a Safe Investment

Initially, my search for a secure investment led me to explore funds managed by so-called investment gurus. I was enticed by one particular fund that promised safety—a notion that quickly dissipated as I witnessed my investment dwindle in both rising and falling markets. The culprit, I discovered, was a combination of high commissions and a fundamentally flawed structure. This experience was a stark reminder that not all that glitters is gold in the world of investment funds.

In parallel, I sought a tax-efficient solution that would avoid the burden of distributions, aiming to retain more of my investment's growth. This criterion further narrowed the field of suitable investment vehicles.

Discovering Berkshire Hathaway's Philosophy

It was during this exploration that I encountered the investment philosophy of Warren Buffett and Charlie Munger, the legendary duo at the helm of Berkshire Hathaway for many, many decades. Their approach, characterized by an aversion to undue risk and a penchant for maintaining a substantial cash position, resonated with my newfound investment ethos. Berkshire's use of insurance float—a pool of cash generated from premiums collected before claims are paid out—further underscored the company's financial prudence.

As I delved deeper, I realized that Berkshire Hathaway's strength lay not only in the stock picks that frequently made headlines but also in its vast array of subsidiaries such as Berkshire Hathaway Energy [BHE], Burlington Northern Santa Fe [BNSF] or Geico. These businesses form the backbone of Berkshire and contribute significantly to its robustness and resilience.

Beyond the Surface: Understanding Berkshire Hathaway

Despite its prominence, Berkshire Hathaway remains an enigma to the general public, with many recognizing only the name of Warren Buffett. The company's culture, which is extraordinary in its focus on shareholders, often goes unnoticed. To truly appreciate Berkshire Hathaway, one must look beyond the surface and understand the intricate web of operations and principles that govern it.

This realization ignited within me a desire to comprehend the company in its entirety. I immersed myself in books and various resources, paying particular attention to the subsidiaries, which I believed would be of interest to a wider audience. It was through this process that I became captivated by the Berkshire Hathaway story.

The Mission of brk-b.com

My fascination with Berkshire Hathaway led me to create brk-b.com, a platform dedicated to providing information that is not readily available to the average investor. Much of the valuable insight into Berkshire's operations is buried within the pages of subsidiary reports and the company's extensive financial disclosures. My goal is to unearth these gems and present them in a manner that is both accessible and engaging.

While I am not a financial expert (please, read that again), I approach my research and writing with a combination of human intuition and the latest in computer technology, including artificial intelligence. This allows me to cross-verify the information and provide a well-rounded perspective as well as decent article writing itself. However, it is important to note that the content on brk-b.com is not intended to serve as investment advice. Rather, it is a resource for those seeking to gain a deeper understanding of Berkshire Hathaway, by shareholders, for shareholders.

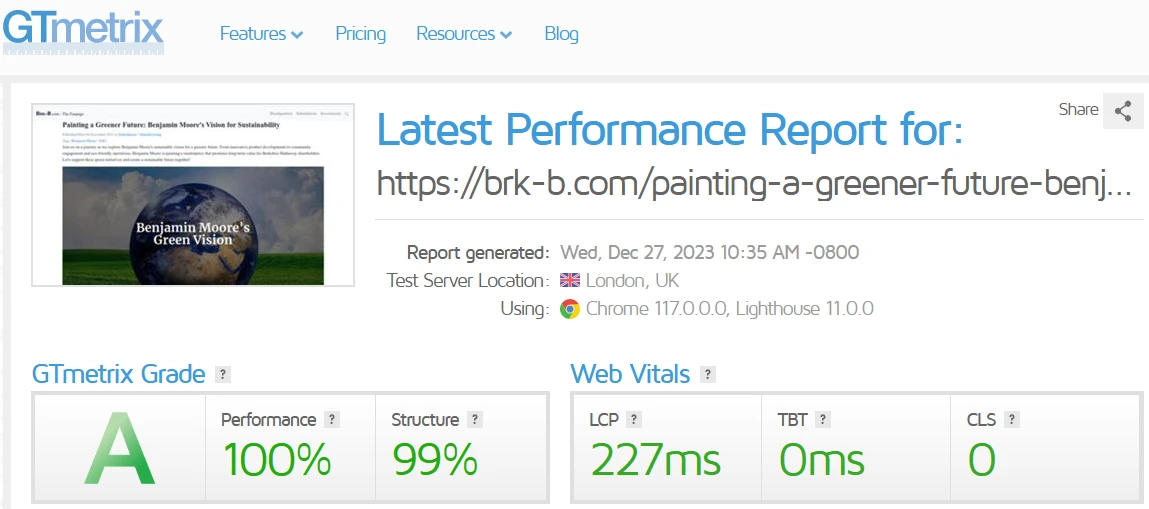

Technology and User Experience

In delivering this information, I have placed a strong emphasis on the user experience. brk-b.com is a static website, which means it is inherently faster and more secure than its dynamic counterparts. Additionally, I enjoy the services of Cloudflare for content distribution, ensuring that the website is accessible from anywhere in the world with minimal delay. Images are optimized for the web to further enhance loading times, providing a seamless experience free from the clutter of advertisements that plague many online financial publications.

Conclusion: A Resource for the Curious Investor

The journey to understanding Berkshire Hathaway is ongoing, and through brk-b.com, I aim to share my findings with fellow investors and curious minds. By focusing on in-depth research, particularly on the subsidiaries, and offering a fast and user-friendly website, I strive to deliver a valuable resource that transcends the typical financial news cycle. Whether you are an experienced investor or simply someone interested in the workings of one of the world's most successful conglomerates, brk-b.com is your gateway to the world of Berkshire Hathaway.

In the spirit of Warren Buffett and Charlie Munger, I invite you to join me in this exploration of sound investment principles, corporate culture, and the intricate tapestry that is Berkshire Hathaway. Let us embark on this journey together, armed with knowledge and an appreciation for the value of a company that stands as a beacon of stability in an ever-changing financial landscape.

Thank you for being on this journey with me, I really appreciate it!

Robert

-

See for example United States M2 Money Supply; Board of Governors of the Federal Reserve System (US), M2 M2SL, retrieved from FRED, Federal Reserve Bank of St. Louis; M2SL, December 30, 2023. M2 Money supply grew short of $300 billion in 1959 to values short of $22 trillion in 2023, around 7% yearly increase. Annual GDP growth in that timeframe has been around 3%, U.S. GDP Growth Rate 1961-2023. One of the main reasons for this monetary expansion might be seen in the expansion of the FED's balance sheet, see Credit and Liquidity Programs and the Balance Sheet; Recent balance sheet trends. ↩

-

The European Central Bank is not better than the FED. Fighting crisis after crisis, the M2 money supply grew from around €4 trillion in 1999 to €15 trillion in 2023, see Monetary aggregates, components and counterparts. That's roughly a 6% yearly increase, which is interesting when compared to an annual GDP growth of around 2% in that same timeframe, see GDP growth (annual %) - Euro area. We may not speculate why this route has been chosen. It is clear, though, that a value-preserving currency might not be the main goal of the central banks. ↩