Tags: Marmon / Earnings

This fanpage is not officially affiliated with Berkshire Hathaway: Disclaimer

Marmon’s 2024 saga: Berkshire Hathaway’s industrial powerhouse reached ~$1.6 billion pre-tax earnings—just shy of the symbolic $2 billion milestone ↗. This article blends historical insights, sectoral analysis, and potential trade policy impacts to reveal Marmon’s resilience amid economic headwinds and its innovation-driven future.

Introduction

In the vast, ever-evolving universe of Berkshire Hathaway, a galaxy of businesses orbits quietly, each contributing its own gravitational pull to the conglomerate’s legendary balance sheet. Among these, Marmon Holdings, Inc. stands as a quietly powerful yet sprawling industrial titan—headquartered in Chicago, Illinois, and employing an impressive 30,000 people across the globe 1. Marmon’s scale is as remarkable as its discretion: eleven diverse business groups and more than 120 autonomous manufacturing and service businesses operate in concert, spanning 18 countries and touching nearly every corner of the industrial landscape 1.

Yet, for all its breadth and operational muscle, 2024 was a year that left Marmon—and its Berkshire shareholders—hovering tantalizingly close to a milestone that’s as much psychological as financial. Pre-tax earnings clocked in at a robust $1.6 billion, a figure that would be the envy of most industrial conglomerates, but still just shy of the coveted $2 billion mark—a threshold that beckons as both a challenge and a promise 2. We have to take these earning into relation to what Berkshire paid for the group: approximately $9 billion 78.

Indeed, 2024 was no ordinary year. Shifting U.S. trade policy—with tariffs reaching their highest levels since 1909—cast long shadows across global supply chains and industrial margins, while economic headwinds and evolving sectoral trends demanded nimbleness and resilience 4. For Marmon, these external forces were both headwinds and proving grounds, testing the mettle of its decentralized model and the wisdom of its diversified portfolio.

This article promises a multidimensional journey: we’ll blend hard numbers, historical context, and a dash of wit to dissect Marmon’s 2024. From the intricate mosaic of its business groups to the sectoral winners and laggards, from the impact of policy tempests to the sparks of innovation, we’ll explore what it means for Berkshire shareholders to own a piece of this industrial juggernaut.

So, as we peel back the layers of Marmon’s 2024, we invite you—our fellow shareholders and curious observers—to look beyond the ledger. Consider not just the numbers, but the narrative: the resilience, the lessons learned, and the road that lies ahead for Berkshire’s industrial giant.

Marmon: The Industrial Mosaic

To understand Marmon is to appreciate the beauty—and complexity—of a true industrial mosaic. Imagine a federation of more than 120 autonomous businesses, each operating with a spirit of independence, yet bound together under the Marmon banner and grouped into eleven distinct sectors. From Foodservice Technologies that keep our beverages cold and our fries hot, to Rail & Leasing operations that move the lifeblood of commerce across continents, Marmon’s reach is as broad as it is deep 1.

Let’s bring order to this industrial constellation. Here’s a snapshot of Marmon’s business groups, their core activities, and key geographies:

| Business Group | Core Activities | Key Geographies |

|---|---|---|

| Foodservice Technologies | Beverage dispensing, food preparation/holding equipment | U.S., Mexico, China, Czech Republic, Italy |

| Water Technologies | Water treatment equipment | U.S., Canada, China, Singapore, India, Poland |

| Transportation Products | Automotive & heavy-duty components, trailers, replacement parts | U.S., Mexico, Canada, Europe, China |

| Retail Solutions | Retail environment design, digital merchandising, fixtures, carts | U.S., U.K., Czech Republic |

| Metal Services | Specialty metal pipe/tubing, value-added services | U.S., India, Poland, Singapore, U.K., others |

| Electrical | Electrical & specialty wire/cable for energy, transit, aerospace, defense, and industry | U.S., Canada, India, England |

| Plumbing & Refrigeration | Copper tubing, HVAC-R components, energy recovery, heat exchange, forgings | U.S., Canada, U.K. |

| Industrial Products | Construction fasteners, anchoring systems, protective wear, gearboxes, lighting, battery equipment | U.S., U.K., Canada, China |

| Rail & Leasing | Railcar manufacturing, leasing, maintenance, intermodal tank containers, rail switching services | U.S., Canada, North America, global |

| Crane Services | Mobile crane leasing (operated/equipment-only), infrastructure, energy, mining, petrochemical markets | North America, Australia |

| Medical | Medical devices for surgery, neurosurgery, aesthetics, powered instruments | U.S., Europe, China, global |

This structure is more than a feat of corporate organization—it’s a modern echo of the great industrial conglomerates of the early 20th century. Think of General Electric or Westinghouse in their heyday, but with a distinctly Berkshire twist: a relentless focus on autonomy, capital discipline, and operational excellence.

Marmon’s 650 manufacturing, distribution, and service facilities are scattered across the U.S. and 17 other countries, producing everything from copper tubing and electrical wire to railcars and medical implants 1. The company’s products and services touch industries as varied as aerospace, construction, energy, agriculture, retail, and healthcare—a testament to its sweeping industrial footprint.

What sets Marmon apart is its decentralized management philosophy, a hallmark of Berkshire Hathaway. Each business operates with significant autonomy, empowered to make decisions close to the customer and the market. This approach fosters entrepreneurial spirit and agility, even as it presents the challenge of driving synchronized growth across such a sprawling portfolio.

Beyond manufacturing, Marmon is a service powerhouse. Its Rail & Leasing group, for example, not only builds and leases railcars, but also maintains a fleet of 119,000 railcars through Union Tank Car Company (UTLX) and Canadian affiliate Procor, serving industries from chemicals to agriculture 1. The Crane Services group operates over 1,100 mobile cranes, offering both operated and equipment-only leases—a reminder that Marmon’s value proposition extends well beyond the factory floor.

Strategically, this diversity is both shield and challenge. It insulates Marmon from sector-specific downturns—when one group stumbles, another may surge—but it also demands deft management to harness growth opportunities and manage risk across the mosaic. In a year as turbulent as 2024, this balancing act was put to the test.

Marmon, in short, is not just a collection of businesses. It’s an industrial ecosystem, thriving on autonomy, diversity, and a relentless drive to serve the world’s most demanding markets. As we turn to the numbers and narratives of 2024, keep this mosaic in mind: it’s the canvas on which Marmon’s story—and Berkshire’s industrial ambitions—are painted.

2024 in Numbers: Growth, Plateau, or Pause?

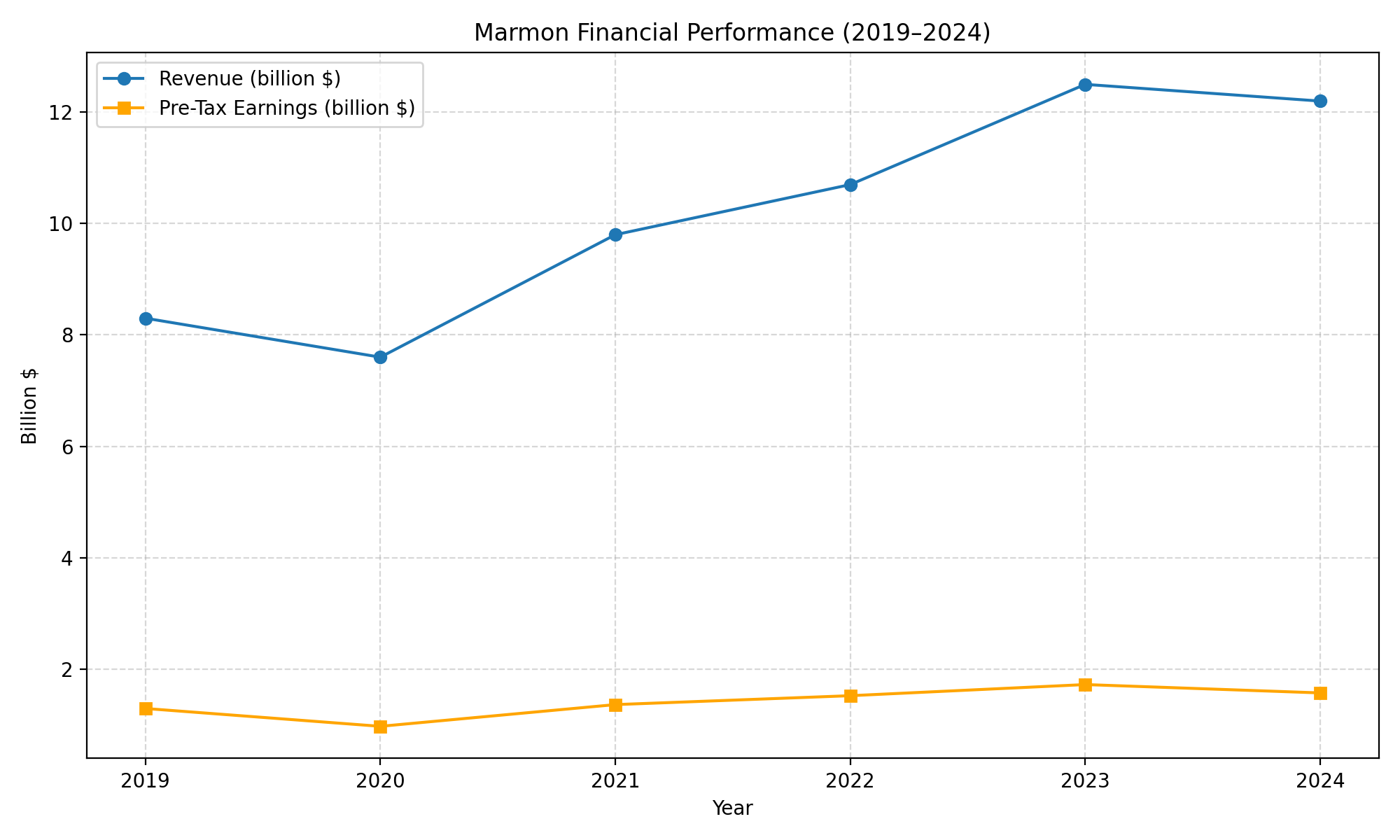

For Berkshire Hathaway shareholders, Marmon Holdings’ 2024 results are a study in contrasts: the company posted $12.2 billion in revenue, a 1.7% decline from 2023, and pre-tax earnings of $1.57 billion, down 8.7% year-over-year 2 ↗. After three years of robust post-pandemic growth, 2024 marks a cooling period—a moment to pause and reflect on what has changed.

Marmon’s Financial Timeline: 2019–2024 26

| Year | Revenue (billion $) | Pre-Tax Earnings (billion $) |

|---|---|---|

| 2019 | 8.3 | 1.29 |

| 2020 | 7.6 | 0.97 |

| 2021 | 9.8 | 1.36 |

| 2022 | 10.7 | 1.52 |

| 2023 | 12.5 | 1.72 |

| 2024 | 12.2 | 1.57 |

Both graph and table tell a story familiar to seasoned investors: 2020’s pandemic-induced contraction gave way to a V-shaped recovery in 2021, and Marmon kept up the momentum through 2023. But 2024’s numbers suggest a plateau, with both revenue and earnings retreating from their highs. The question is: Is this a temporary pause, or the start of a new era of slower growth?

To answer that, it’s instructive to compare Marmon’s trajectory to the broader U.S. industrial landscape. According to Federal Reserve data, industrial production increased at a 5.5% annualized rate in Q1 2024, but stumbled with a 0.3% decline in March 5. Manufacturing output rose 0.3% in March, with durable goods leading the way, but capacity utilization at 77.8% remains below the long-run average. In other words, the sector is expanding, but not without turbulence—mirroring Marmon’s own experience.

For Berkshire shareholders, the psychological importance of the $2 billion pre-tax earnings milestone looms large. Marmon is now within striking distance, but 2024’s setback underscores that crossing this threshold is no foregone conclusion. The company remains a steady, if unspectacular, contributor to Berkshire’s bottom line—its industrial backbone, less flashy than insurance or energy, but vital to the conglomerate’s resilience.

What’s driving this 2024 plateau? The answer lies in a mix of external headwinds—from shifting industrial demand to commodity price volatility—and internal sectoral dynamics. Some Marmon business groups surged ahead, while others stumbled. This mosaic performance sets the stage for a closer look at the winners and losers within the Marmon empire.

Winners and Losers: Marmon’s Sectoral Scorecard

Marmon’s strength has always been its diversity: eleven business groups, over 120 autonomous companies, and a presence in nearly every corner of the industrial economy 1. In 2024, that diversity proved both a buffer and a challenge, as fortunes diverged sharply across the portfolio.

2024 disclosed Group Performance at a Glance 21

| Business Group | Revenue Change (%) | Earnings Change | Key Drivers/Notes |

|---|---|---|---|

| Rail & Leasing | +10.5 | Up | Higher lease renewal rates, increased railcar repair prices/volumes |

| Electrical | +6.0 | Down | Higher copper prices and volumes, but offset by material costs and unfavorable business mix |

| Medical | Not disclosed | Up | Innovation, MicroAire’s NEOSYAD acquisition; strong demand in surgical devices |

| Water Technologies | Not disclosed | Up | Growth in water treatment equipment across global markets |

| Foodservice Technologies | Not disclosed | Up | Demand for beverage/food equipment in U.S., Europe, Asia |

| Transportation Products | -18.2 | Down | Volume declines in truck, trailer, and aftermarket automotive markets |

| Metal Services | -13.9 | Down | Reduced volume, unfavorable sales mix |

| Retail Solutions | -9.4 | Down | Lower volumes, sales mix changes |

| Crane Services | Not disclosed | Down | Lower revenues, higher costs, seasonality |

Standout Winner: Rail & Leasing

The Rail & Leasing group emerged as Marmon’s star performer in 2024, with revenue up 10.5%. This was driven by higher lease renewal rates and increased repair prices and volumes—a testament to the enduring demand for tank cars and intermodal containers, especially in chemicals, energy, and agriculture. Utilization rates remain high, thanks to Marmon’s selective capital investment and the long-term nature of its leases. UTLX and Canadian affiliate Procor now own about 119,000 railcars, providing a stable revenue base 12.

Electrical: Growth with Caveats

The Electrical group posted a 6.0% revenue increase, buoyed by higher copper prices and increased volumes. However, this growth came at a cost: earnings declined due to rising material costs and an unfavorable business mix. It’s a classic case of top-line growth not translating into bottom-line gains—a reminder that cost pressures remain a persistent challenge in industrial manufacturing 2.

Laggards: Transportation, Metals, and Retail

On the flip side, the Transportation Products group suffered an 18.2% revenue drop, reflecting steep volume declines in truck, trailer, and aftermarket automotive markets. The Metal Services group fell 13.9%, and Retail Solutions was down 9.4%, both hit by lower volumes and changing sales mix. These declines underscore the cyclical sensitivity of these sectors to macroeconomic shifts and evolving customer demand 2.

Crane Services: Weathering the Storm

The Crane Services group—with its fleet of 1,100 mobile cranes serving energy, mining, and infrastructure—also struggled. Revenues fell, costs rose, and seasonality (with volume concentrated in warmer months) compounded the challenge. Even in critical markets, operational leverage cuts both ways when demand softens 12.

Bright Spots: Medical, Water, and Foodservice Technologies

Not all was gloom. The Medical group delivered earnings growth, propelled by innovation and strategic moves like MicroAire’s acquisition of NEOSYAD, a leader in adipose tissue engineering. This deal expands MicroAire’s portfolio and global reach, positioning Marmon at the forefront of advanced surgical solutions 3. Water Technologies and Foodservice Technologies also posted earnings gains, capitalizing on global demand for water treatment and foodservice equipment 2.

The Power—and Complexity—of Diversity

Marmon’s sectoral diversity remains its greatest strength and its most intricate challenge. When one group stumbles, another may surge, cushioning the impact on the whole. But synchronized growth across all segments remains elusive. For Berkshire shareholders, 2024 is a reminder that Marmon’s industrial mosaic is both a shield and a puzzle—capable of weathering storms, but always demanding careful stewardship.

2025: Navigating the Trade and Policy Tempest

This year, Marmon Holdings finds itself navigating a storm not seen in over a century: a US tariff environment that catapulted the average tariff rate to 22.5%—the highest since 1909 4. For industrial titans like Marmon, this was more than a policy shift; it was a seismic event, reminiscent of the infamous Smoot-Hawley Tariff Act of the 1930s. That era’s protectionism deepened the Great Depression, teaching future generations that trade barriers can have far-reaching and unintended consequences. Today’s tempest, while different in its global complexity, echoes those lessons for conglomerates whose supply chains and customer bases span continents.

The 2025 tariff hikes are fastly evolving with new headlines arising every week. Whatever number will come out, these tariffs are acute for sectors at the heart of Marmon’s industrial mosaic. Steel, aluminum, and auto parts—core inputs for Marmon’s Transportation Products, Metal Services, and Electrical groups—might face tariffs as high as 25%. Even more dramatic, tariffs on Chinese imports soared to (currently) 125%, while Canada and Mexico saw 25% rates on non-USMCA goods 4. These moves sent shockwaves through Marmon’s 650 manufacturing, distribution, and service facilities across 18 countries, likely driving up input costs, disrupting established supply chains, and forcing rapid recalibration of sourcing and pricing strategies 1.

But the tempest does not stop at America’s borders. China retaliated with tariffs on all US imports, while the European Union (initially) imposed 20% tariffs. For Marmon’s global operations—especially in Water Technologies, Foodservice, and Medical groups with significant footprints in Europe and Asia—these retaliatory measures threatened to erode export competitiveness and squeeze margins 4. The likely result: a complex web of higher costs, shifting trade flows, and rising uncertainty.

Yet, the policy mix is not entirely bleak. Corporate tax rates for domestic manufacturers fell to 15%, offering some relief and a modest incentive for capital investment. However, this was offset by federal spending cuts and the relentless upward pressure on input costs, creating a mixed bag for Marmon’s investment calculus 4. The net effect is caution: business investment slowed, and the broader US economy braced for slower real GDP growth—forecast to dip to 1.9% in 2025 and 0.8% in 2026—with inflation eroding consumer purchasing power and the specter of a technical recession by late 2025 looming large 4.

In this environment, Marmon’s diversified structure might prove both shield and sword. The breadth of its eleven business groups and over 120 autonomous businesses provided resilience, enabling the company to weather shocks in one sector with strength in others. But the lesson this year is clear: agility is no longer optional. As trade winds shift and policy storms gather, Marmon’s ability to adapt—rapidly, globally, and strategically—will define its future as Berkshire Hathaway’s industrial titan. Marmon is likely to be following the trade war news closely, as its very businesses largely depend on the outcome.

Innovation Amidst Adversity

2025’s policy headwinds test Marmon’s resilience, but innovation powered its forward momentum 2024 ↗. The year was marked by bold moves and quiet revolutions across Marmon’s sprawling portfolio, proving that adversity often catalyzes the greatest leaps.

One standout example is the MicroAire acquisition of NEOSYAD, a move that instantly positioned Marmon’s Medical group at the forefront of adipose tissue engineering. MicroAire, already a global leader in power-assisted liposuction, welcomed NEOSYAD’s AdiMate device and Adipure single-use kit—both recently granted EU MDR approval—into its portfolio 3. The AdiMate’s patented “all-in-one” technology, which automates infiltration, liposuction, and tissue preparation, enables surgeons to deliver higher quality outcomes in less time. As MicroAire President Jerome Barrillon noted, “Their expertise, innovative products, and dedication to advancing adipose tissue technologies perfectly align with our mission to enable better patient outcomes and support plastic surgeons worldwide”3. This integration not only expands MicroAire’s leadership in a fast-growing field but also exemplifies Marmon’s commitment to delivering value through innovation, even in challenging times.

But innovation at Marmon is not confined to the operating room. Across its business groups, Marmon advanced product and process innovation in ways both visible and subtle. The Foodservice Technologies group rolled out next-generation beverage dispensing and food preparation systems in the US, Europe, and Asia. Water Technologies continued to push the envelope in water treatment solutions, leveraging R&D hubs from Belgium to Singapore. The Retail Solutions group harnessed digital merchandising and smart fixtures to redefine the in-store experience. Meanwhile, Plumbing & Refrigeration introduced energy recovery systems and advanced HVAC solutions for data centers and pharmaceutical sites, addressing both efficiency and sustainability 1.

Government regulation and environmental compliance have long been double-edged swords for Marmon, especially in the Rail & Leasing and Medical groups. Regulatory oversight, while demanding, has spurred Marmon to raise the bar on safety, quality, and environmental stewardship. The company’s ongoing monitoring and remediation of environmental matters, and its strict adherence to all federal, state, and local regulations, underscore a commitment to responsible growth 1. In a world where environmental and social governance increasingly shape market access and customer trust, Marmon’s proactive stance is both a challenge and a competitive advantage.

Crucially, Marmon’s global footprint—spanning the US, Europe, Asia, and beyond—has become a wellspring for R&D, manufacturing, and market access. By tapping into diverse talent pools, regulatory environments, and customer needs, Marmon ensures that innovation is not just a buzzword but a lived reality across its operations 1.

Ultimately, it is this capacity for innovation amidst adversity that sets Marmon apart. In a world roiled by trade shocks and economic uncertainty, the company’s ability to adapt, evolve, and lead is its true competitive edge—and a source of enduring value for Berkshire Hathaway shareholders.

The Road Ahead: Lessons, Risks, and Opportunities

Marmon’s 2024 journey offers Berkshire Hathaway shareholders a rich tapestry of lessons, risks, and opportunities—each underscoring the complex reality of managing a sprawling industrial empire in an era defined by uncertainty and rapid change. At its core, the year reaffirmed the resilience born of diversity. Marmon’s eleven business groups and over 120 autonomous companies form a mosaic that cushions shocks and balances sectoral volatility. This decentralized model, a hallmark of Berkshire’s industrial philosophy, remains a powerful shield against cyclical downturns and trade disruptions alike12. Yet, 2024 also exposed the limits of scale: size alone does not guarantee synchronized growth or immunity from external headwinds. The plateau in revenue and earnings reminds us that even titans must continuously innovate and adapt to maintain momentum.

Innovation emerged as Marmon’s true north in 2024, illuminating pathways through adversity. The MicroAire acquisition of NEOSYAD exemplifies how targeted, strategic moves can expand capabilities and open new markets, particularly in high-growth, technology-driven sectors like medical devices3. Across its portfolio, Marmon’s commitment to product and process innovation—whether in water treatment, foodservice, or energy-efficient HVAC systems—demonstrates a forward-looking mindset essential for long-term value creation. Moreover, the company’s proactive approach to regulatory and environmental challenges positions it well in a world where ESG considerations increasingly influence capital allocation and customer loyalty1.

However, the road ahead is not without formidable risks. Persistent trade frictions and tariff volatility continue to cloud the global industrial landscape 2025, driving input cost inflation and complicating supply chains 4. Marmon’s exposure to steel, aluminum, and automotive components markets makes it particularly sensitive to these dynamics. Coupled with regulatory complexity—both domestic and international—and the looming threat of a cyclical economic downturn, these factors demand vigilant risk management and strategic agility. Volatile commodity prices and geopolitical uncertainties further underscore the need for flexibility and resilience in capital allocation and operational planning.

Amid these challenges, clear opportunities beckon. The Rail & Leasing group’s strong performance in 2024 highlights a durable growth engine, underpinned by high utilization rates and long-term lease contracts 12. Expansion in Medical and Water Technologies offers promising avenues for margin enhancement and market share gains, driven by innovation and global demand for health and sustainability solutions 23. Additionally, Marmon’s track record of strategic acquisitions, as seen with NEOSYAD, suggests further consolidation and capability-building potential that could accelerate growth and diversify risk.

Looking forward, Marmon’s decentralized management philosophy—while a source of strength—may require evolution. To unlock the next level of industrial excellence, fostering greater cross-group synergies and coordinated innovation could amplify growth and operational efficiency. This shift would echo Berkshire Hathaway’s own historical journey: from a collection of disparate businesses to a more integrated conglomerate capable of leveraging scale without sacrificing autonomy. Like Berkshire itself, Marmon stands at a crossroads where steady adaptation and a keen eye for opportunity will define its trajectory.

For Berkshire shareholders, the role is clear: to remain patient capital, providing Marmon the latitude to weather storms and invest in long-term value creation. The near-miss of the $2 billion pre-tax earnings milestone in 2024 is not a setback but a challenge—a reminder that greatness is forged over time, through cycles of trial, learning, and renewal.

Marmon’s story is far from finished. The next chapter promises not only the pursuit of bigger numbers but the crafting of a new model for industrial leadership—one that blends autonomy with collaboration, innovation with discipline, and resilience with ambition. As Berkshire’s industrial titan inches closer to the $2 billion mark, shareholders can take confidence in a company that, much like its parent, remains steady, adaptive, and ever poised for the next great opportunity.

References

-

2024 Annual Report - Marmon - www.berkshirehathaway.com ↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩

-

2024 Annual Report - Marmon (Results of Operations) - www.berkshirehathaway.com ↩↩↩↩↩↩↩↩↩↩↩↩

-

MicroAire Completes Acquisition of NEOSYAD | Marmon Holdings - www.marmon.com ↩↩↩↩↩

-

US Economic Forecast: Tariffs update - www2.deloitte.com ↩↩↩↩↩↩↩

-

Board of Governors of the Federal Reserve System - www.federalreserve.gov ↩

-

Pre-tax earnings are calculated from provided changes in several Berkshire annual reports, so there might be rounding errors. ↩

-

Berkshire Hathaway paid a total of approximately $9.2 billion for Marmon Holdings. This includes $4.8 billion for 63.6% in 2008, $1.5 billion for an additional 16.6% in 2010, $1.4 billion for 9.8% in 2012, and $1.47 billion for nearly all remaining shares in 2013 8. ↩

-

Berkshire's ‘hidden’ mega-business: What is Marmon Holdings? - omaha.com ↩↩