Tags: BHE

This fanpage is not officially affiliated with Berkshire Hathaway: Disclaimer

Following the full acquisition of Pilot Travel Centers earlier this year ↗, there remained an open question about how Berkshire would allocate the approximately $277 billion still undeployed ↗. There has been a move. A significant one. Berkshire Hathaway is acquiring the remaining 8% stake in Berkshire Hathaway Energy ↗. Let’s take a closer look.

Introduction

In a bold strategic maneuver, Berkshire Hathaway has taken full control of its energy empire by acquiring the remaining stake in Berkshire Hathaway Energy (BHE) from the Scott family for a total of about $4 billion 3. This acquisition, which increases Berkshire's ownership from 92% to 100%, marks a significant milestone for Berkshire Hathaway. Known for his long-term vision and strategic foresight, Buffett's decision to consolidate ownership of BHE reflects a calculated move to strengthen Berkshire Hathaway's position as a leader in the renewable energy sector. In 2000, Berkshire first invested in what was then known as MidAmerican Energy. Over the years, this investment has transformed into a cornerstone of Berkshire's diversified portfolio, culminating in the complete acquisition of BHE.

Owning 100% of BHE not only solidifies Berkshire Hathaway's standing in the energy industry but also positions the conglomerate as a formidable player in the renewable energy landscape ↗↗. With BHE's extensive portfolio, including wind, solar, geothermal, and hydroelectric projects, Berkshire is poised to capitalize on the growing demand for sustainable energy solutions. This acquisition is not just a financial transaction; it is a strategic move that reinforces Berkshire's commitment to a sustainable future and its role as a leader in the energy transition.

Strategic Vision and Historical Context

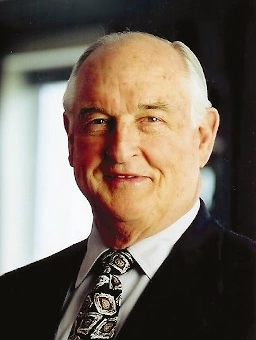

The acquisition of the remaining stake in BHE is deeply rooted in the historical relationship between Warren Buffett and Walter Scott Jr., a longtime friend and influential figure on the Berkshire board. Scott, who passed away in 2021, was not only a childhood friend of Buffett but also a key player in the development of BHE. His legacy and contributions to the company are reflected in this strategic acquisition, which honors their shared vision for the future of energy 4.

Greg Abel's leadership at BHE has been instrumental in its growth and success. Having led the company for a decade, Abel's decision to sell his 1% stake to Berkshire in 2022 set the stage for his anticipated succession as CEO. This move underscores the strategic importance of the energy sector to Berkshire Hathaway's diversified portfolio and highlights BHE's role as a major player in renewable energy 1.

BHE's evolution from MidAmerican Energy to its current status as a leading energy company is marked by key milestones, including the 2014 rebranding to Berkshire Hathaway Energy. This transformation reflects Berkshire's strategic vision and commitment to innovation and sustainability. The acquisition's timing is particularly noteworthy, as it comes at a moment when U.S. Treasury yields are falling, presenting a unique opportunity for growth and expansion in the energy sector 1.

The full ownership of BHE opens up new synergies and growth opportunities, particularly in the realm of renewable energy projects. With a diversified portfolio that includes utility companies, electricity distribution, natural gas pipelines, and renewable energy investments, BHE is well-positioned to drive Berkshire's strategic vision forward. This acquisition not only enhances Berkshire's market position but also aligns with its long-term goals of sustainability and innovation in the energy industry 2.

Financial Implications and Market Position

Berkshire Hathaway's acquisition of the remaining 8% of BHE is valued at approximately $3.9 billion. This transaction, executed through a combination of cash, Berkshire stock, and newly issued debt, elevates Berkshire's ownership to a full 100% of BHE 3. The purchase price of $650 per share for the Scott estate's stake was notably below BHE's book value of around $50 billion, positioning the entire business at an estimated value of $49 billion 3. This strategic move underscores Berkshire's adept negotiation skills and its commitment to strengthening its foothold in the energy sector.

When comparing BHE's valuation to industry peers such as Duke Energy and American Electric Power, which are valued at approximately twice their book value, the acquisition appears even more financially astute 3. This strategic acquisition not only consolidates Berkshire's control over BHE but also underscores the company's ability to capitalize on undervalued assets in the market.

BHE's total equity, standing at $51,2 billion as of June 30, 2024, reflects its robust financial foundation and diversified portfolio within the energy industry 2 ↗, see also our appendix below the article. The company's significant investments in renewable energy, including wind, solar, geothermal, and hydroelectric projects, highlight its role as a leader in the transition to sustainable energy sources. Furthermore, BHE's position as one of the largest residential real estate brokerage firms in the U.S. adds another layer of diversification to its business operations 2.

However, the financial landscape is not without its challenges. BHE has reserved nearly $3 billion for potential wildfire losses, primarily associated with its utility PacifiCorp, signaling the financial impact of ongoing litigation and the inherent risks within the energy sector 3. Despite these challenges, BHE reported a net income of $1.7 billion in the first half of the year, showcasing its resilience and profitability 3.

To provide a clearer picture of BHE's diverse operations, the following table outlines its business segments and their contributions to the company's overall financial health:

| Business Segment | Key Operations |

|---|---|

| PacifiCorp | Utility services in 11 U.S. states |

| MidAmerican Funding | Primarily MidAmerican Energy |

| NV Energy | Nevada Power and Sierra Pacific |

| Northern Powergrid | Northeast plc and Yorkshire plc in Great Britain |

| BHE Pipeline Group | BHE GT&S, Northern Natural Gas, Kern River |

| BHE Transmission | BHE Canada/AltaLink and BHE U.S. Transmission |

| BHE Renewables | Investments in wind, solar, geothermal, hydroelectric |

| HomeServices | Residential real estate brokerage firm in the U.S. |

BHE's strategic investments and diversified portfolio position it as a formidable player in the energy market, with the potential to capitalize on emerging opportunities and navigate industry challenges effectively.

Economic and Regulatory Landscape

The acquisition of full ownership of BHE occurs against a backdrop of a rapidly evolving U.S. clean energy market. The forecasted addition of almost 1 terawatt of new solar and wind capacity between 2024 and 2035 is set to drive an 80% increase in the U.S.'s nameplate power generation capacity, even with planned power plant retirements 5. This growth trajectory underscores the immense potential for BHE to expand its renewable energy footprint and reinforce its market position.

However, BHE must navigate a complex regulatory landscape, characterized by potential new import tariffs on solar cells from Southeast Asia and batteries from China, which may elevate U.S. equipment costs 5. Additionally, the need for expanded grid infrastructure to accommodate rising electricity demand from data centers and manufacturing presents both challenges and opportunities for BHE's growth prospects 5.

Reflecting on the historical evolution of the U.S. energy sector, BHE's role in shaping its future is reminiscent of past industry transformations. The potential for regulatory reforms to facilitate interregional grid planning and centralized permitting could significantly impact BHE's strategic direction, offering opportunities to enhance grid reliability and reduce congestion 5.

BHE's strategic investments in renewable energy projects, including wind, solar, geothermal, and hydroelectric, are pivotal to its long-term success. These investments not only align with global sustainability goals but also position BHE as a leader in the transition to a cleaner energy future 2.

Key regulatory and economic factors influencing BHE's strategic direction and market position include:

- Growth in solar and wind capacity: Significant expansion expected between 2024 and 2035 5.

- Potential import tariffs: Impact on solar cells and batteries could affect equipment costs 5.

- Rising electricity demand: Driven by data centers and manufacturing, necessitating expanded grid infrastructure 5.

- Regulatory reforms: Opportunities for improved grid planning and permitting processes 5.

- Investments in renewables: Strategic focus on wind, solar, geothermal, and hydroelectric projects 2.

Thus, BHE's strategic positioning within the economic and regulatory landscape underscores its potential to drive innovation and growth in the energy sector, while navigating the challenges that lie ahead.

Conclusion

Berkshire Hathaway's acquisition of the remaining 8% stake in Berkshire Hathaway Energy (BHE) for $2.37 billion represents a pivotal moment in the company's history, underscoring its commitment to long-term strategic vision and the renewable energy sector. This bold move not only consolidates Berkshire's ownership of BHE from 92% to 100%, but it also reinforces its position as a leading player in the energy landscape. The transaction, which involved a combination of cash and stock, was executed at a price below the company's book value, showcasing Warren Buffett's astute negotiation skills and his ability to capitalize on undervalued assets in a competitive marketplace.

Historically, Buffett's relationship with Walter Scott Jr. and the Scott family has been instrumental in shaping BHE's trajectory. The acquisition honors Scott's legacy and reflects the long-standing friendship and shared vision that has guided Berkshire's energy investments since the early 2000s. As BHE has evolved from MidAmerican Energy to a diversified energy powerhouse, it has become a cornerstone of Berkshire's portfolio, particularly in the realm of renewable energy ↗. With significant investments in wind, solar, geothermal, and hydroelectric projects, BHE is well-positioned to lead the charge in the transition to a sustainable energy future.

Looking ahead, the leadership of Greg Abel, who is expected to succeed Buffett, will be crucial as BHE navigates the complex regulatory landscape and the challenges posed by rising electricity demand and potential import tariffs on solar and battery technologies. The anticipated growth in U.S. solar and wind capacity presents both opportunities and challenges for BHE, as the company must adapt to evolving market conditions and regulatory frameworks. The projected 80% increase in nameplate power generation capacity by 2035 highlights the immense potential for BHE to expand its renewable energy footprint, but it also necessitates strategic planning and investment in infrastructure to meet rising demand.

Berkshire Hathaway's full ownership of BHE is not just a financial maneuver; it is a strategic alignment with the global sustainability goals that are increasingly shaping the energy sector. As the company embarks on this new chapter, it stands at the forefront of the renewable energy revolution, poised to leverage its extensive portfolio and expertise to drive innovation and growth. The legacy of Warren Buffett, characterized by visionary leadership and a commitment to long-term value creation, will undoubtedly influence the future of Berkshire Hathaway under Greg Abel's stewardship. As BHE continues to expand its reach and impact, shareholders can look forward to a promising horizon filled with opportunities for sustainable growth and market leadership in the energy sector.

Appendix: BHE Balance Sheet Q2 2024

Below is the balance sheet for BHE, as detailed in the second quarter report 2. At a book value of around $51.2 billion, 8% of the company are worth about $4 billion.

| June 30, 2024 | December 31, 2023 | |

|---|---|---|

| ASSETS | ||

| Current assets: | ||

| Cash and cash equivalents | $3,265 | $1,565 |

| Investments and restricted cash and cash equivalents | $1,911 | $1,253 |

| Trade receivables, net | $2,685 | $2,667 |

| Inventories | $1,755 | $1,509 |

| Mortgage loans held for sale | $705 | $451 |

| Regulatory assets | $1,176 | $1,398 |

| Other current assets | $960 | $1,355 |

| Total current assets | $12,457 | $10,198 |

| Property, plant and equipment, net | $101,012 | $99,248 |

| Goodwill | $11,494 | $11,547 |

| Regulatory assets | $4,216 | $4,167 |

| Investments and restricted cash and cash equivalents and investments | $8,847 | $9,510 |

| Other assets | $3,112 | $3,170 |

| Total assets | $141,138 | $137,840 |

| LIABILITIES AND EQUITY | ||

| Current liabilities: | ||

| Accounts payable | $2,818 | $3,175 |

| Accrued interest | $798 | $625 |

| Accrued property, income and other taxes | $1,007 | $828 |

| Accrued employee expenses | $499 | $354 |

| Short-term debt | $985 | $4,148 |

| Current portion of long-term debt | $3,895 | $2,740 |

| Other current liabilities | $2,227 | $1,551 |

| Total current liabilities | $12,229 | $13,421 |

| BHE senior debt | $11,455 | $13,101 |

| BHE junior subordinated debentures | $100 | $100 |

| Subsidiary debt | $41,020 | $36,231 |

| Regulatory liabilities | $6,876 | $6,644 |

| Deferred income taxes | $12,235 | $12,437 |

| Other long-term liabilities | $6,017 | $6,166 |

| Total liabilities | $89,932 | $88,100 |

| Commitments and contingencies (Note 10) | ||

| BHE shareholders' equity: | ||

| Common stock - 115 shares authorized, no par value, 76 shares issued and outstanding | — | — |

| Additional paid-in capital | $5,573 | $5,573 |

| Retained earnings | $46,371 | $44,765 |

| Accumulated other comprehensive loss, net | ($2,033) | ($1,904) |

| Total BHE shareholders' equity | $49,911 | $48,434 |

| Noncontrolling interests | $1,295 | $1,306 |

| Total equity | $51,206 | $49,740 |

| Total liabilities and equity | $141,138 | $137,840 |

References

-

Berkshire Hathaway buys full control of its energy unit - www.reuters.com ↩↩

-

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the quarterly period ended June 30, 2024 - www.brkenergy.com ↩↩↩↩↩↩

-

Price in Buying Stake in Its Own Utility Unit - www.barrons.com ↩↩↩↩↩↩

-

Walter Scott Jr. - Wikipedia - en.wikipedia.org ↩

-

1H 2024 US Clean Energy Market Outlook: Moving Past 2030 | BloombergNEF - about.bnef.com ↩↩↩↩↩↩↩↩

-

Walter Scott Junior by Engr2-scotts, licensed under CC BY-SA 3.0. ↩