Tags: Warren Buffett / History

This fanpage is not officially affiliated with Berkshire Hathaway: Disclaimer

As Warren Buffett celebrated his 94th birthday on August 30th 2024, Berkshire Hathaway reaches a historic $1 trillion market cap, a testament to his visionary leadership and investment prowess. Dive into this article to explore the remarkable journey, unique strategies, and enduring legacy of the Oracle of Omaha.

Introduction

As Warren Buffett, the legendary investor known as the Oracle of Omaha, celebrated his 94th birthday on August 30th, 2024, the financial world has another monumental milestone to commemorate: Berkshire Hathaway has surpassed a market capitalization of $1 trillion. This remarkable achievement is not only a fitting birthday present for Buffett but also a testament to his unparalleled investment acumen and long-term vision 13.

Berkshire Hathaway's ascent to a $1 trillion market cap is historic, marking it as the first non-technology company to reach this pinnacle 3. This milestone underscores the sheer magnitude of Berkshire's success under Buffett's leadership, highlighting the company's evolution from a struggling textile firm to a diversified conglomerate with holdings in GEICO, Burlington Northern Santa Fe railroad, and significant stakes in companies like Apple and Coca-Cola 1.

In this article, we will delve into Buffett's illustrious journey, exploring his early beginnings, the acquisition and transformation of Berkshire Hathaway, his investment philosophy, and the consistent performance that has defined his career. We will also examine the economic and historical context of this milestone, the challenges and opportunities navigated along the way, and the profound impact of Buffett's leadership on the financial world.

The Oracle of Omaha: A Legacy of Success

Warren Buffett's journey to becoming one of the world's most renowned investors began with humble entrepreneurial ventures. As a young boy, Buffett demonstrated an innate business acumen, selling gum, Coca-Cola, and magazines door-to-door. At the tender age of 11, he made his first stock purchase, buying three shares of Cities Service Preferred for himself and his sister 4. These early experiences laid the foundation for his future success and instilled in him a deep understanding of the value of money and investment.

Buffett's acquisition of Berkshire Hathaway in the 1960s was a pivotal moment in his career. Originally a failing textile company, Berkshire Hathaway was transformed under Buffett's stewardship into a diversified conglomerate with a market capitalization that now exceeds $1 trillion 34. This transformation was driven by Buffett's adherence to value investing principles, a philosophy he learned from his mentor, Benjamin Graham. Buffett's famous investment mantra, “be fearful when others are greedy and greedy when others are fearful,” encapsulates his approach to investing and has guided his decision-making process over the decades 14.

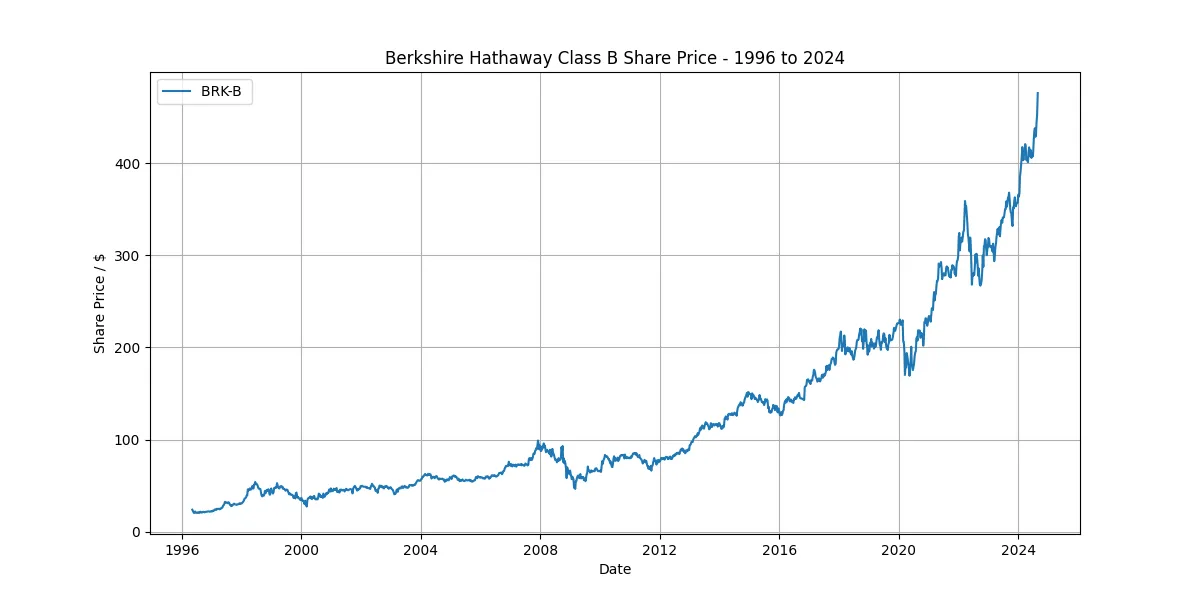

Under Buffett's leadership, Berkshire Hathaway has averaged an annual gain of about 20 percent since 1965, a performance that significantly outpaces the S&P 500's average annual return of 10.2 percent over the same period 13. This consistent performance is a testament to Buffett's long-term vision and patience, qualities that have been crucial to his success. As Steve Check aptly noted, “He's the most patient investor ever, which is a big reason for his success” 3.

In addition to his investment prowess, Buffett is also known for his philanthropic efforts. He has pledged to give away 99 percent of his fortune to philanthropy and co-founded the Giving Pledge with Bill Gates in 2010 4. This commitment to giving back underscores Buffett's belief in using wealth to make a positive impact on society.

Beyond his financial achievements, Buffett is a man of many interests and talents. He enjoys playing the ukulele, a hobby he picked up in his youth, and leads a relatively humble lifestyle despite his immense wealth. These personal anecdotes humanize the financial titan and offer a glimpse into the character of a man who has remained grounded despite his extraordinary success 4.

As we continue to explore the road to $1 trillion, the challenges and opportunities faced by Berkshire Hathaway, and the broader historical and economic context, it becomes clear that Warren Buffett's legacy is one of vision, discipline, and unwavering commitment to his principles. His journey serves as an inspiration to investors and business leaders worldwide, demonstrating the power of patience, strategic thinking, and a long-term perspective.

The Road to $1 Trillion

Berkshire Hathaway's journey to a $1 trillion market cap is a story of strategic acquisitions and disciplined investment. The company's diverse portfolio includes major subsidiaries like GEICO, Burlington Northern Santa Fe (BNSF) Railway, and significant stakes in Apple and Coca-Cola 1 6. This diversification has allowed Berkshire to navigate various market conditions effectively, ensuring steady growth.

Berkshire's shares rose by 0.7 percent on August 28th 2024, the day it first hit the $1 trillion mark, culminating in a year-to-date gain of over 28 percent 1. This impressive performance added more than $200 billion to its market capitalization, a clear indicator of the company's robust financial health and strategic prowess.

To put this into perspective, the S&P 500 has seen a 17.2 percent gain for the year 1. Berkshire's outperformance highlights its resilience and ability to generate superior returns even in fluctuating market conditions. This consistent outperformance is a hallmark of Buffett's investment strategy, which has averaged a gain of about 20 percent per year since he took over in 1965 1.

Berkshire's portfolio is a mosaic of high-performing subsidiaries ↗. GEICO and BNSF Railway are cornerstones of its operations, while stakes in tech giant Apple and beverage leader Coca-Cola add significant value ↗135. These investments are not just financial assets but strategic moves that align with Buffett's philosophy of investing in companies with strong fundamentals and growth potential.

A substantial portion of Berkshire's earnings and valuation comes from its insurance operations ↗, which account for over a third of its earnings and half of its valuation 6. The insurance business provides a steady stream of income and investment flexibility, thanks to the premiums received through its property/casualty insurance business. This "float" can be invested until claims need to be paid, offering a unique financial advantage ↗.

Berkshire's financial strength is further underscored by its record cash pile of $277 billion 36. This massive reserve provides the company with unparalleled investment flexibility, allowing it to capitalize on opportunities as they arise. Whether it's acquiring new businesses or investing in market downturns, this cash reserve is a strategic asset that sets Berkshire apart.

The economic environment over the decades has seen its share of ups and downs, but Berkshire has consistently navigated these fluctuations with remarkable agility. From the economic boom of the late 20th century to the financial crises of the early 21st century, Berkshire's growth trajectory has been influenced by a combination of strategic foresight and disciplined execution. This historical context highlights the resilience and adaptability that have been key to Berkshire's sustained success.

Navigating Challenges and Opportunities

While Berkshire Hathaway's journey to a $1 trillion market cap is a testament to its strengths, it also faces a myriad of challenges and opportunities that will shape its future.

Berkshire operates in highly competitive and cyclical markets, particularly in its insurance and non-insurance operations 6. The insurance business, though profitable, is subject to market cycles that can lead to significant losses. Similarly, non-insurance businesses like BNSF Railway are economically sensitive and heavily focused on US markets, making them vulnerable to domestic economic fluctuations.

One of the challenges Berkshire faces due to its sheer size is finding large acquisition targets. The company needs significant investment opportunities to move the needle on its vast portfolio, but such opportunities are increasingly rare 6. This necessitates a strategic approach to capital allocation, ensuring that every investment aligns with the company's long-term goals.

Several of Berkshire's non-insurance businesses are economically sensitive, meaning their performance is closely tied to the health of the US economy 6. This economic sensitivity requires a keen understanding of market trends and a proactive approach to managing risks. The focus on US markets, while beneficial in many ways, also means that Berkshire's fortunes are closely tied to the domestic economic landscape.

Berkshire has made several strategic adjustments recently to navigate these challenges. The company reduced its stake in Apple and Bank of America ↗, reallocating capital to Treasury bills 6. These moves reflect a cautious approach to market volatility and a focus on preserving capital while seeking new investment opportunities.

As Warren Buffett celebrated his 94th birthday, the question of succession has become increasingly pertinent. Greg Abel, Buffett's designated successor, will play a crucial role in shaping Berkshire's future 3 5. Abel's leadership will be pivotal in maintaining the company's strategic direction and ensuring that Buffett's investment philosophy continues to guide its operations ↗.

Despite its successes, Berkshire faces governance concerns related to the board structure and voting discrepancies between Class A and Class B shares 6. These issues highlight the need for a transparent and equitable governance framework that aligns with shareholder interests and ensures robust oversight.

While Berkshire Hathaway's journey to a $1 trillion market cap is a remarkable achievement, it is not without its challenges. Navigating competitive markets, finding large deals, managing economic sensitivity, and ensuring a smooth leadership transition are critical factors that will shape the company's future. With its strong foundation and strategic foresight, Berkshire is well-positioned to continue its legacy of success under the guidance of its new leadership.

The Impact of Buffett's Leadership

Warren Buffett's leadership has been nothing short of transformative for Berkshire Hathaway. Since taking the helm in 1965, Buffett has steered the company to an astounding annualized return, far outpacing the S&P 500's over the same period 3. This remarkable performance is a testament to Buffett's investment acumen and the power of compounding returns over decades. Under his guidance, Berkshire's stock has increased by an eye-popping 4,384,748%, compared to the S&P 500's 31,223% return 3. Such figures underscore the immense value created for shareholders and highlight the effectiveness of Buffett's long-term strategy.

Central to Buffett's success is his patient and disciplined approach to investing. This quality has been instrumental in his ability to navigate market fluctuations and capitalize on opportunities when others are fearful 3. This philosophy is encapsulated in Buffett's famous quote: "We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful." His unwavering commitment to this principle has consistently yielded substantial returns.

Buffett's influence extends far beyond Berkshire Hathaway. His investment philosophy has inspired countless investors, including Howard Marks, who credits Buffett for motivating him to write his book, "The Most Important Thing: Uncommon Sense for the Thoughtful Investor" 3. Buffett's ability to distill complex financial concepts into simple, actionable advice has made him a revered figure in the investment community. His annual letters to shareholders are eagerly anticipated for their blend of business insights and humor, offering valuable lessons with a folksy, Midwestern charm 4.

The annual shareholder meetings in Omaha, affectionately dubbed the "Woodstock of Capitalism," are a testament to Buffett's enduring appeal and the culture he has cultivated at Berkshire Hathaway 1 4. These gatherings draw tens of thousands of attendees, eager to hear Buffett's wisdom and celebrate the company's success. The meetings are a unique blend of business and camaraderie, reflecting Buffett's belief in transparency and open communication with shareholders.

Buffett's enthusiasm and joy for his work have been pivotal to his longevity and success 10. As Howard Marks observed, Buffett approaches investing "with gusto and joy," a sentiment echoed by Buffett himself, who often says he "skips to work in the morning" 3. This passion for his craft has not only driven his remarkable achievements but also inspired others to pursue their own goals with similar fervor.

Warren Buffett's continued success with Berkshire Hathaway clearly shows he hasn't lost his touch at an age of 94—a question that has repeatedly surfaced over the past few decades ↗.

Berkshire Hathaway's achievement of surpassing a $1 trillion market valuation is a monumental milestone, particularly as it becomes the first non-technology company to reach this threshold 3. This accomplishment places Berkshire in the annals of economic history, alongside other significant market events. It underscores the company's resilience and adaptability in an ever-evolving economic landscape.

The significance of Berkshire's achievement is further highlighted by the broader market context. While the S&P 500 has seen a 17.2% gain for the year, Berkshire's shares have risen by over 28%, adding more than $200 billion to its market capitalization 1. This performance is a testament to the company's robust business model and Buffett's strategic vision.

Berkshire Hathaway's journey to a $1 trillion market cap is also a story of economic resilience ↗. The company has weathered numerous economic cycles and crises, emerging stronger each time. From the acquisition of a failing textile company in the 1960s to becoming a conglomerate with diverse holdings, including GEICO, BNSF Railway, and a substantial equity portfolio, Berkshire's evolution reflects its ability to adapt and thrive in changing economic conditions 3.

Warren Buffett's leadership has not only propelled Berkshire Hathaway to unprecedented heights but also left an indelible mark on the investment world. His patient, disciplined approach and passion for his work have created immense value for shareholders and inspired generations of investors. As Berkshire continues to navigate the complexities of the global economy, it stands as a testament to the enduring power of sound investment principles and strategic leadership.

Conclusion

As we celebrate Warren Buffett's remarkable journey and his 94th birthday, we also commemorate a historic milestone for Berkshire Hathaway: the achievement of a $1 trillion market capitalization. This landmark not only reflects the extraordinary growth and resilience of the company but also serves as a testament to Buffett's visionary leadership and unwavering commitment to his investment principles. Over nearly seven decades, Buffett has transformed Berkshire from a struggling textile manufacturer into the world's largest holding company, demonstrating the power of patience, discipline, and a long-term perspective in investing 13.

Looking ahead, the future of Berkshire Hathaway appears promising under the stewardship of Greg Abel, Buffett's designated successor. As the company navigates the complexities of a dynamic economic landscape, it will face both challenges and opportunities. The need to identify significant acquisition targets and manage economic sensitivity will be paramount in maintaining Berkshire's legacy of success. However, with a robust cash reserve of $277 billion and a diversified portfolio that includes industry giants like GEICO and Apple, Berkshire is well-positioned to adapt and thrive 3 5.

Buffett's legacy extends far beyond the impressive financial metrics and milestones. His investment philosophy has inspired countless investors and shaped the way we approach the markets. As Howard Marks aptly noted, Buffett's approach is characterized by a unique blend of insight, discipline, and a genuine joy for investing. His famous mantra, “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful,” encapsulates the essence of his strategy and serves as a guiding principle for generations of investors 3.

As we reflect on this historic moment, let us take a moment to appreciate the remarkable journey of Berkshire Hathaway and the impact of Warren Buffett's leadership. His contributions to the world of investing are profound, and his commitment to philanthropy further underscores his belief in using wealth to create positive change in society ↗ ↗.

We encourage all shareholders to continue supporting Berkshire's long-term vision and investment philosophy, drawing inspiration from Buffett's timeless wisdom. As he often reminds us, investing is not just about numbers; it’s about understanding the businesses behind those numbers and the people who drive them.

As we celebrate this significant milestone, let us remember Buffett's words: “The stock market is designed to transfer money from the Active to the Patient.” This sentiment resonates now more than ever, reminding us of the enduring value of patience and strategic thinking in the pursuit of success. Here's to the future of Berkshire Hathaway and the legacy of its legendary leader, Warren Buffett.

References

-

Warren Buffett’s Berkshire Hathaway Hits $1 Trillion in Market Value - www.nytimes.com ↩↩↩↩↩↩↩↩↩↩↩↩

-

Berkshire Hathaway Inc. (BRK-B) - finance.yahoo.com ↩

-

Warren Buffett leads Berkshire Hathaway to new heights at age 94 - www.cnbc.com ↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩

-

How Warren Buffett Made Berkshire Hathaway a Winner - www.investopedia.com ↩↩↩

-

Warren Buffett's Berkshire Hathaway is Worth $1 Trillion. Should I Buy Shares? - www.morningstar.co.uk ↩↩↩↩↩↩↩↩

-

Op-Ed: The growing life-expectancy gap between rich and poor - www.latimes.com ↩↩

-

2024 Second Quarter Report - www.berkshirehathaway.com ↩

-

Of course Berkshire Hathaway shareholders can be extremely thankful for Warren Buffett's longevity. However, in examining the broader societal trends, the growing life expectancy gap between rich and poor in the United States is a stark reminder of the disparities that exist within our society 7. Higher-income individuals, like Buffett, benefit from better healthcare, nutrition, and living conditions, contributing to longer life expectancies. This trend has significant implications for Social Security and retirement planning. As Gary Burtless noted, it seems unfair that low-income workers do not see similar gains in life expectancy as the rich 7. Warren Buffett has tried to revolutionize United States Healthcare back in 2018, but the team consisting of Berkshire Hathaway, Amazon and JPMorgan was not successful ↗. ↩