Tags: GEICO / Earnings

This fanpage is not officially affiliated with Berkshire Hathaway: Disclaimer

What a whirlwind week it has been since the release of Berkshire Hathaway’s 2024 annual report! Berkshire’s Class B shares are trading around $514, pushing the company’s market cap to approximately $1.1 trillion 8. Meanwhile, a historic clash unfolded at the White House between Presidents Trump and Zelensky of Ukraine 9. But let’s focus on the standout success story from this year’s report: In 2024, GEICO has undergone a remarkable transformation, delivering record underwriting profits and solidifying its strategic significance within Berkshire Hathaway.

Introduction

Two years ago, at Berkshire’s 2023 annual shareholder meeting, Ajit Jain emphasized the significant effort required to get the company back on track 10 ↗. Today, that hard work has paid off—GEICO’s turnaround has been nothing short of a tremendous success: In a year that can only be described as extraordinary, GEICO has emerged as a phoenix rising from the ashes, marking a remarkable turnaround in 2024. This transformation has not only revitalized GEICO's standing but has also significantly bolstered the fortunes of its parent company, Berkshire Hathaway. As a key subsidiary, GEICO plays a crucial role in the conglomerate's overall success, and its recent achievements have not gone unnoticed. In Warren Buffett's 2024 annual report, GEICO received special recognition for its outstanding contribution to Berkshire's performance 2.

The strategic initiatives and operational improvements undertaken by GEICO have led to impressive financial results, showcasing the company's resilience and adaptability in a challenging market. This article aims to take shareholders on a journey through GEICO's strategic decisions, market position, and future prospects, drawing parallels between its transformation and other notable corporate turnarounds.

As we delve into GEICO's storied past, we will explore its historical context, strategic turnaround in 2024, and the broader implications for Berkshire Hathaway. This comprehensive analysis will provide shareholders with a deeper understanding of GEICO's achievements and its pivotal role in the conglomerate's success.

The Historical Context

Founded in 1936 by Leo and Lillian Goodwin, GEICO began its journey with a focus on providing insurance to government employees 3 ↗. This niche market allowed the company to establish a strong foundation, setting the stage for its future growth. By 1949, GEICO had become a publicly traded company, attracting the interest of investors, including a young Warren Buffett, who famously referred to GEICO as "The Security I Like Best" in 1951 3.

The company faced significant challenges during the 1973–75 recession, reporting a loss of $126.5 million. However, through a strategic reorganization led by John J. Byrne and supported by Buffett, GEICO managed to recover and expand its market reach. In 1974, the company began insuring the general public, marking a pivotal shift in its business model 3.

Over the decades, GEICO has consistently ranked as one of the largest auto insurers in the U.S., a testament to its enduring market presence and strategic acumen. Its position within Berkshire Hathaway further solidifies its importance, contributing significantly to the conglomerate's financial health 3.

GEICO's historical commitment to the military community is another cornerstone of its legacy. Since its founding, the company has maintained a strong relationship with military families, a tradition that continues today with initiatives like its partnership with Operation Homefront 5. This long-standing dedication underscores GEICO's values and its role as a socially responsible corporate entity.

Strategic Turnaround and Financial Performance 2024

In 2024, GEICO embarked on a remarkable transformation under the strategic leadership of Todd Combs, a manager at Berkshire Hathaway. This year marked a phoenix-like resurgence for the company, as it achieved record underwriting profits of $7.8 billion, more than double the previous year's total 7. The turnaround was driven by a series of decisive cost-cutting measures, including a significant reduction in headcount by over 30% since the end of 2021, bringing the workforce down to approximately 28,000 employees 7. This strategic move not only streamlined operations but also led to a 24% decrease in annual operating expenses, which stood at $4.1 billion in 2024 7.

The financial health of GEICO was further bolstered by a 13% increase in revenues during the same period 7. This impressive growth was a testament to the company's renewed focus on efficiency, with an operating expense ratio that remained under 10%, significantly lower than competitors like Progressive 7. Such efficiency gains have positioned GEICO as a formidable player in the insurance industry, offering a competitive edge that few can match.

However, the transformation was not without its challenges. GEICO faced the daunting task of overhauling its technological infrastructure, which consisted of more than 600 legacy systems that were not fully integrated 7. The transition to a more streamlined system was crucial for improving operational efficiency and customer service.

The impact of these strategic changes on GEICO's market position was profound. Warren Buffett himself acknowledged the reshaping of GEICO, praising the increased efficiency and modernized underwriting practices 7. Ajit Jain also highlighted the technological challenges and the ongoing efforts to compress the number of systems, indicating a commitment to future-proofing the company 7. Together, these insights from industry leaders underscore the significance of GEICO's transformation and its promising outlook for the future.

GEICO's financial performance in 2024 was nothing short of impressive. The company saw a substantial increase in premiums written, which rose by $3.1 billion (7.7%) compared to 2023, reaching a total of $42,916 million 1. Similarly, premiums earned increased by $3.0 billion (7.6%), reflecting the company's robust growth trajectory 1. This upward trend in financial metrics was complemented by a significant reduction in losses and loss adjustment expenses, which decreased by $1.5 billion (4.7%) 1. The loss ratio improved markedly, dropping to 71.8% in 2024 from 81.0% in the previous year 1.

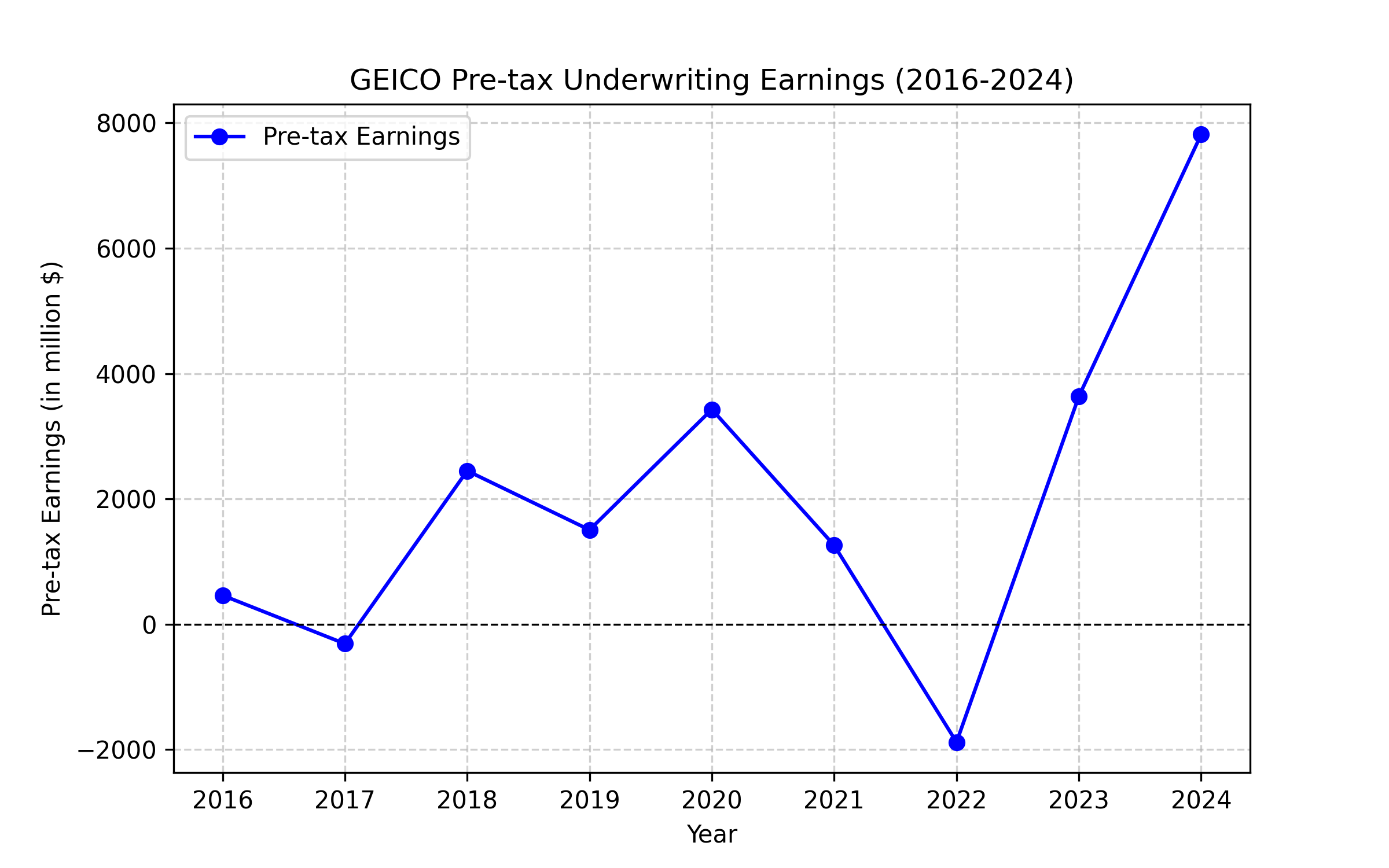

A table of GEICO's operating results over the years illustrates this growth in pre-tax underwriting earnings (from 2024's annual report 1, combined with data from previous reports) - amounts in million dollars:

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|

| Premiums written | $42,916 | $39,837 | $39,107 | $38,395 | $34,928 | $36,016 | $34,123 | $30,547 | $26,309 |

| Premiums earned | $42,252 | $39,264 | $38,984 | $37,706 | $35,093 | $35,572 | $33,363 | $29,441 | $25,483 |

| Losses and loss adjustment expenses | $30,331 | $31,814 | $36,297 | $30,999 | $26,018 | $28,937 | $26,278 | $25,497 | $21,044 |

| Underwriting expenses | $4,108 | $3,815 | $4,567 | $5,448 | $5,647 | $5,129 | $4,636 | $4,254 | $3,977 |

| Total losses and expenses | $34,439 | $35,629 | $40,864 | $36,447 | $31,665 | $34,066 | $30,914 | $29,751 | $25,021 |

| Pre-tax underwriting earnings (loss) | $7,813 | $3,635 | $(1,880) | $1,259 | $3,428 | $1,506 | $2,449 | $(310) | $462 |

Let us have a short look at the most important figure of merit: pre-tax earnings, which outlines the historic context of the earnings graphically:

Almost $8 billion in pre-tax earnings! Even from the outstanding first months of 2024, we could not have expected such a result ↗!

Despite a slight decrease in market share to approximately 12.3% in 2023, GEICO remained the second-largest auto insurer in the U.S. 1. The competitive landscape saw GEICO pitted against major players like State Farm, Progressive, Allstate, and USAA 1. The company's marketing strategies, emphasizing cost-efficient direct response methods and customer satisfaction, played a crucial role in maintaining its strong market position 1.

Key factors contributing to GEICO's improved profitability included an increase in average premiums per auto policy and a decline in claims frequencies 1. The company's approach to managing and settling claims, utilizing its own claims staff, further enhanced operational efficiency and customer satisfaction 1. These strategic initiatives have fortified GEICO's market position and laid a solid foundation for future growth.

GEICO did make its homework, Ajit Jain, Todd Combs and the team delivered!

Operational Achievements and Challenges

In 2024, GEICO demonstrated remarkable operational achievements, positioning itself as a beacon of innovation and resilience within the insurance industry. One of the most notable accomplishments was the expansion of its commercial insurance business, driven by the introduction of new products like long-haul trucking insurance. This strategic move not only diversified GEICO's offerings but also tapped into a burgeoning market segment, contributing significantly to its growth trajectory 4. The establishment of a new operations hub in North Texas, which added 500 new jobs, underscores GEICO's commitment to scaling its commercial insurance operations. This expansion is a testament to the thriving business environment in North Texas and GEICO's strategic foresight in capitalizing on regional opportunities 4.

Moreover, GEICO's partnership with Operation Homefront highlights its longstanding commitment to supporting military families. This collaboration includes programs like Holiday Meals for Military® and Back-to-School Brigade®, reinforcing GEICO's dedication to its roots and its foundational customer base 5. Such initiatives not only enhance GEICO's corporate social responsibility profile but also strengthen its brand loyalty among military communities.

However, GEICO's path to success in 2024 was not without challenges. The company faced significant operational hurdles, including the need to modernize its technology infrastructure. With over 600 legacy systems that lacked integration, GEICO undertook the daunting task of streamlining its operations to enhance efficiency and competitiveness 7. This technological overhaul is crucial for maintaining GEICO's edge in a rapidly evolving digital landscape.

Additionally, GEICO's strategic decision to reduce its workforce by over 30% since 2021, coupled with office relocations, was aimed at optimizing its cost structure and improving operational efficiency 3. While these measures led to a notable decrease in annual operating expenses, they also posed challenges in maintaining employee morale and corporate culture. Despite these challenges, GEICO's efforts to foster a strong corporate culture and work-life balance earned it recognition as one of America's Most Admired Workplaces for 2025 6. This accolade reflects GEICO's commitment to creating a positive work environment, even amidst significant organizational changes.

Looking ahead, GEICO faces the potential impact of increased advertising expenditures in 2025, which could affect its expense ratio and market positioning 7. Balancing these investments with operational efficiency will be crucial for sustaining its competitive advantage and market share.

GEICO's Role in Berkshire Hathaway's Success

GEICO has emerged as a pivotal contributor to Berkshire Hathaway's success, significantly bolstering the conglomerate's overall operating income. As outlined for 2024, GEICO's underwriting profit soared to $7.8 billion, more than doubling its 2023 total and reversing a nearly $2 billion loss from 2022 2. This remarkable turnaround was instrumental in Berkshire Hathaway achieving a total operating income of $47.4 billion after taxes, marking a 27% increase from the previous year 2.

Warren Buffett himself acknowledged GEICO's critical role in Berkshire's better-than-expected performance in 2024, despite more than half of its 189 operating businesses reporting a decline in earnings 2 ↗. This recognition underscores GEICO's strategic importance within Berkshire's diverse portfolio, serving as a cornerstone of stability and profitability.

GEICO's impact on Berkshire's market capitalization and investor confidence is reminiscent of historical corporate success stories ↗. The synergies between GEICO and other Berkshire subsidiaries contribute to a cohesive and diversified business model, enhancing the conglomerate's resilience in the face of market fluctuations.

The long-term benefits of GEICO's strategic initiatives extend beyond immediate financial gains. By streamlining operations, expanding product offerings, and fostering a culture of innovation, GEICO is well-positioned to continue driving Berkshire Hathaway's success. Warren Buffett's vision for GEICO's future emphasizes its continued role as a key driver of Berkshire's growth, with a focus on maintaining competitive advantages and adapting to evolving market dynamics.

GEICO's operational achievements and strategic importance within Berkshire Hathaway exemplify its role as a phoenix rising for shareholders. As GEICO continues to innovate and adapt, it remains a vital asset in Berkshire's portfolio, contributing to the conglomerate's sustained success and shareholder value.

Future Prospects and Challenges

As GEICO navigates the dynamic landscape of 2024 and beyond, its future prospects are shaped by a blend of strategic growth initiatives and potential hurdles. The company is poised to explore market expansion and product diversification strategies, aiming to tap into emerging markets and broaden its insurance offerings. This approach not only seeks to capture new customer segments but also to enhance GEICO's competitive edge in a saturated market.

However, the road ahead is not without challenges. Evolving consumer preferences demand a shift towards more personalized and digital insurance solutions. As consumers increasingly prioritize convenience and customization, GEICO must adapt its offerings to meet these expectations. Additionally, regulatory changes pose another layer of complexity, requiring GEICO to stay agile and compliant with evolving industry standards.

The impact of technological advancements is another critical factor shaping GEICO's future. The integration of artificial intelligence and machine learning can revolutionize GEICO's operations, from underwriting to claims processing, enhancing both efficiency and customer experience. Embracing these technologies will be essential for GEICO to maintain its market position and drive innovation.

In alignment with broader industry trends, GEICO is also focusing on sustainability and corporate social responsibility. This commitment not only enhances GEICO's brand reputation but also aligns with the growing consumer demand for environmentally conscious and socially responsible companies. By integrating sustainable practices into its core operations, GEICO can position itself as a forward-thinking leader in the insurance industry.

The implications of natural disasters and climate-related risks are increasingly significant for insurance companies ↗. GEICO must refine its claims and underwriting practices to account for the rising frequency and severity of such events. By implementing robust risk assessment models and leveraging data analytics, GEICO can better anticipate and mitigate these risks, ensuring financial stability and customer trust.

Innovation remains at the heart of GEICO's strategy, with a strong focus on digital transformation to enhance market position and customer engagement. By investing in cutting-edge technologies and fostering a culture of continuous improvement, GEICO aims to deliver superior customer experiences and streamline its operations.

Looking ahead, GEICO's long-term vision and strategic priorities are centered on solidifying its leadership in the insurance industry. By balancing growth initiatives with a keen awareness of potential challenges, GEICO is well-positioned to emerge as a resilient and innovative force, much like a phoenix rising from the ashes, ready to deliver value to its shareholders and stakeholders alike.

Conclusion

In 2024, GEICO has truly exemplified a phoenix rising from the ashes, showcasing a remarkable transformation that has not only revitalized its operations but also significantly enhanced its financial performance. The strategic turnaround led by Todd Combs has resulted in record underwriting profits of $7.8 billion, a testament to the effectiveness of decisive cost-cutting measures and a renewed focus on operational efficiency. This achievement highlights GEICO's resilience and adaptability in a challenging market, aligning with the historical context of its journey from a niche insurer to a leading player in the auto insurance industry.

Reflecting on GEICO's storied past, we can draw parallels with other notable corporate transformations, such as the resurgence of companies like Apple and IBM, which have navigated through adversity to emerge stronger. GEICO's ability to learn from its challenges and implement strategic initiatives mirrors these success stories, reinforcing the notion that resilience and innovation are crucial for long-term sustainability in today's competitive landscape.

As a vital subsidiary of Berkshire Hathaway, GEICO's contributions to the conglomerate's overall performance cannot be overstated ↗. The recognition from Warren Buffett in his annual report underscores the strategic importance of GEICO within Berkshire's diverse portfolio. The company's impressive financial results have played a pivotal role in bolstering Berkshire Hathaway's operating income, further solidifying GEICO's status as a cornerstone of stability and profitability.

For Berkshire shareholders, the key takeaways from GEICO's journey are clear: the company is poised for continued growth and profitability. With its strategic focus on market expansion, product diversification, and technological advancements, GEICO is well-positioned to navigate the evolving insurance landscape. However, challenges such as changing consumer preferences and regulatory pressures must be met with agility and foresight.

Looking ahead, GEICO's commitment to excellence, innovation, and customer satisfaction will be paramount in ensuring its sustained success. As the company embraces digital transformation and prioritizes sustainability, it is set to become a forward-thinking leader in the insurance industry. Shareholders are encouraged to stay informed and engaged with GEICO's ongoing developments and achievements, as the company's trajectory promises to deliver significant value in the years to come.

GEICO's remarkable achievements in 2024 serve as an inspiring reminder of the power of strategic vision and operational excellence. As it continues to rise and thrive, GEICO remains dedicated to its mission of providing outstanding service and value to its customers, ensuring its place as a formidable force in the insurance sector.

References

-

2024 Annual Report - GEICO - www.berkshirehathaway.com ↩↩↩↩↩↩↩↩↩↩

-

Polished Gem GEICO Fuels Berkshire Hathaway Operating Gains - Carrier Management - www.carriermanagement.com ↩↩↩↩

-

GEICO selects North Texas as newest operations hub for its commercial insurance business; will add 500 new jobs - www.geico.com ↩↩

-

GEICO announces partnership with Operation Homefront to support the military community - www.geico.com ↩↩

-

GEICO recognized as one of America's Most Admired Workplaces for 2025 by Newsweek - www.geico.com ↩

-

Berkshire Hathaway Borrows From Elon Musk’s Playbook in Geico Turnaround - www.barrons.com ↩↩↩↩↩↩↩↩↩↩

-

Berkshire Hathaway Inc. (BRK-B) Stock Price, News, Quote & History - Yahoo Finance - finance.yahoo.com ↩

-

Tears and shock in Ukraine and Europe after heated Zelensky-Trump meeting - www.washingtonpost.com ↩

-

Berkshire's Jain on GEICO Profit: 'Don't Take It to the Bank'; Tech Needs Rebuild - Carrier Management - www.carriermanagement.com ↩