Tags: History / Gold / Comments

This fanpage is not officially affiliated with Berkshire Hathaway: Disclaimer

Embark on a captivating journey through the investment landscape as we dissect the performance of gold, Berkshire Hathaway, and the S&P 500 from 2002 to 2024. Discover the contrasting philosophies of Warren Buffett and gold advocates, and unravel the psychological and economic factors that shape investment decisions. Whether you're a seasoned shareholder or a curious investor, this article will challenge your perceptions and inspire you to navigate the ever-changing market with wisdom and insight.

Introduction

The year 2002 stood as a watershed moment for investors worldwide. The dust was settling from the burst of the dot-com bubble, and the financial landscape was ripe for reevaluation. In this climate of uncertainty and change, two contrasting investment philosophies emerged. On one side stood Warren Buffett, the "Oracle of Omaha," with a net worth of around US$100 billion, known for his shrewd investment strategies and leadership at Berkshire Hathaway 1. Buffett's approach to investing has always been rooted in finding long-term value in productive assets, such as stocks, bonds, real estate, and farms 3.

On the other side of the debate, Robert Kiyosaki, author of "Rich Dad, Poor Dad," championed gold as a vital investment, particularly as a hedge against economic uncertainty and inflation 3. This dichotomy sets the stage for a compelling comparative analysis of three distinct investment choices from 2002 to 2024: gold, Berkshire Hathaway, and the S&P 500.

The ongoing debate pits gold, often viewed as a 'safe haven' during turbulent times, against stocks, which are seen as productive assets capable of generating wealth 4. This article aims to dissect the performance and controversies surrounding these investment choices, particularly for shareholders of Berkshire Hathaway. Through historical data, expert opinions, and economic events, we will embark on an analytical journey to understand the dynamics and outcomes of these investments over the past two decades.

The Oracle of Omaha vs. The Precious Metal

Warren Buffett's investment philosophy has always emphasized the importance of investing in assets that not only hold value but also produce it. He has famously built his fortune by investing in shares, preferring ownership in companies with strong fundamentals and the ability to generate profits over time 4. This focus on productive assets aligns with his belief that investments should yield returns that can be reinvested, compounding wealth.

In stark contrast to this view, gold has traditionally been seen as a store of value, a reliable safe haven during times of crisis, and a hedge against inflation 1. Despite its allure, Buffett has been vocal about his skepticism towards gold as an investment. He has highlighted gold's two significant shortcomings: its limited utility and its non-procreative nature, meaning it cannot produce anything 14. "Gold... has two significant shortcomings, being neither of much use nor procreative," Buffett once remarked, encapsulating his central theme that gold, unlike shares, is a non-productive asset.

Even though Berkshire Hathaway briefly dabbled in the gold market by investing in Barrick Gold in Q2 2020 ↗, the company exited this position just two quarters later, underscoring Buffett's lack of long-term commitment to gold as an asset class 1. This move was seen as a strategic play rather than a shift in investment philosophy.

The psychological and historical allure of gold cannot be ignored, however. Investors like Kiyosaki are drawn to its perceived stability and protection against currency debasement and money printing 3. Yet, from the perspective of Berkshire Hathaway's investment principles, gold does not align with the company's focus on acquiring and holding productive assets.

Performance Showdown: Berkshire vs. Gold vs. S&P 500

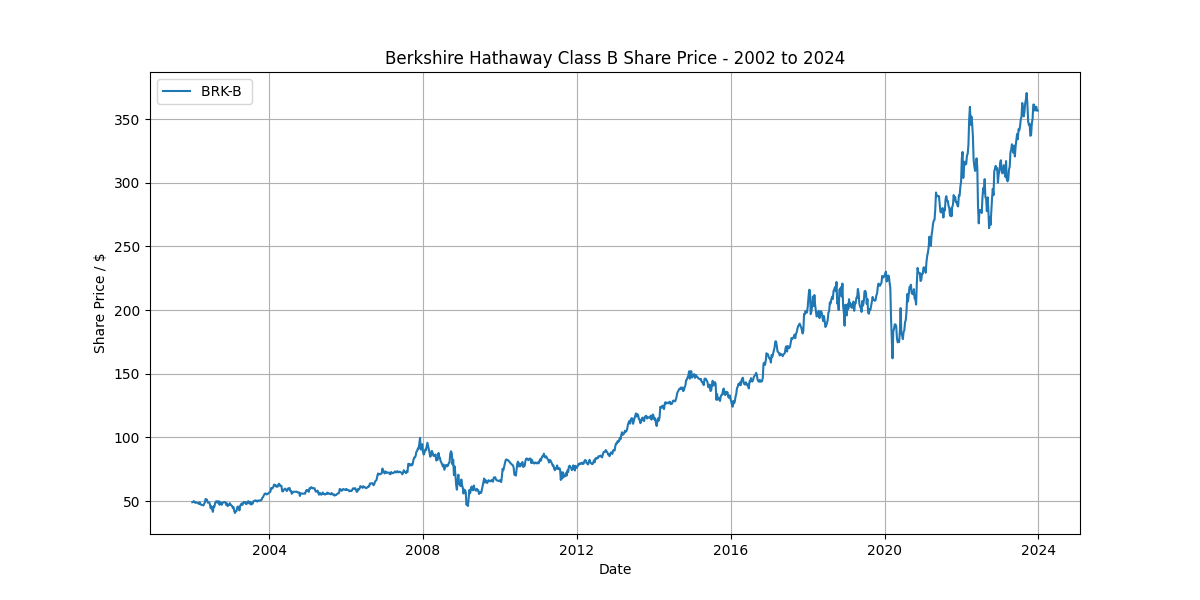

To objectively assess the performance of Berkshire Hathaway, gold, and the S&P 500, we must look at the numbers. From 2002 to 2024, Berkshire Hathaway Class B shares saw a remarkable increase from $49.18 to $356.66, showcasing the company's ability to create substantial shareholder value 2. The price appriciation corresponds to approximately 9.0% annual return for the given timeframe. This growth is a testament to Buffett's investment strategy and the company's robust portfolio of productive assets:

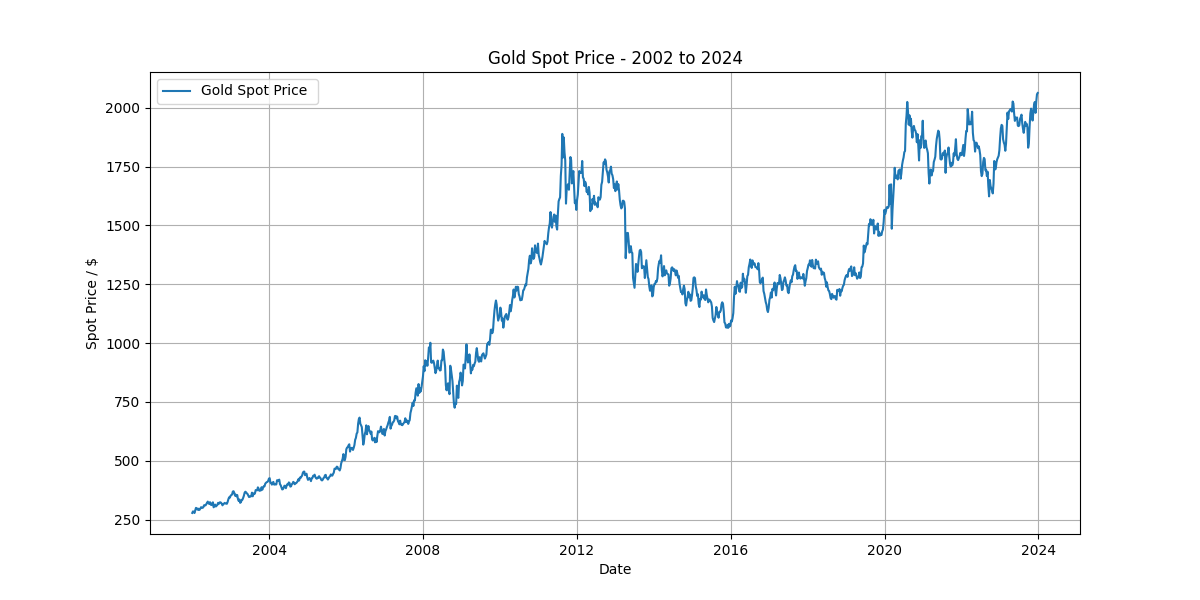

Gold, on the other hand, experienced significant price swings, with the spot price per ounce rising from $278.60 in 2002 to a peak of $2062.40 in 2024 2, an approximate 9.1% annual return. Gold's performance often peaked during periods of economic stress, reflecting its role as a go-to asset during times of uncertainty.

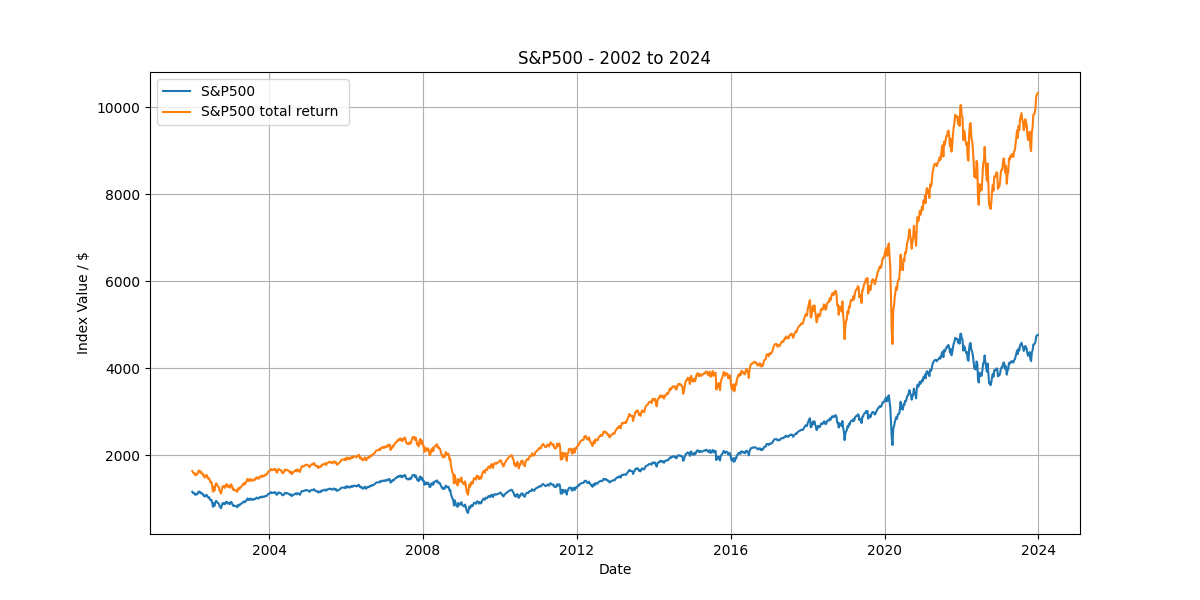

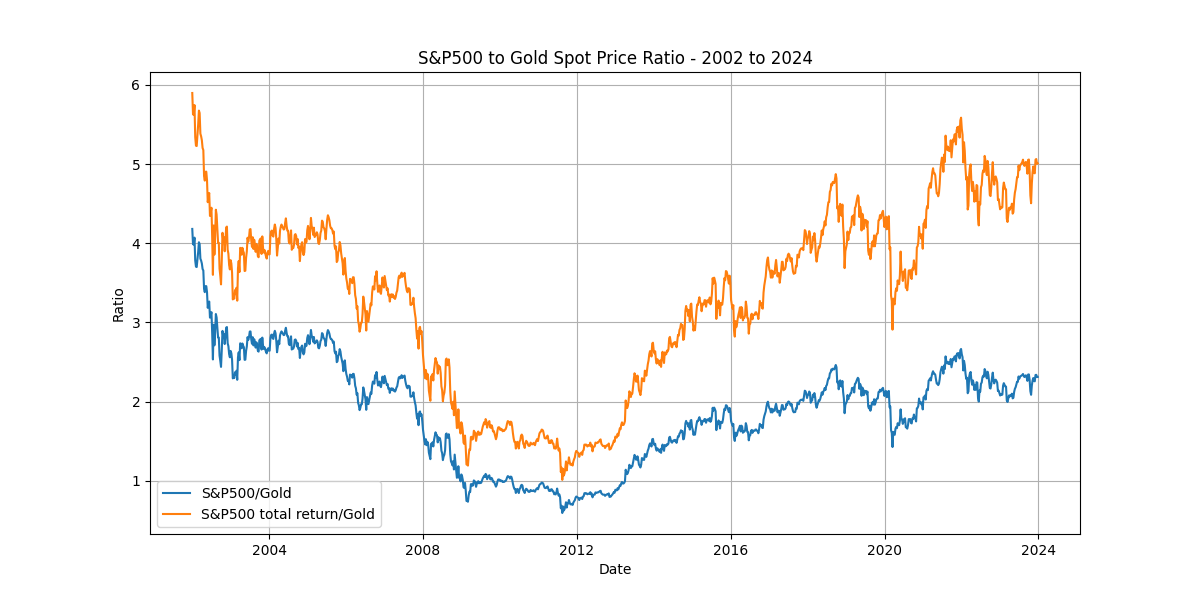

The S&P 500 also demonstrated strong growth, with the index climbing from $1164.89 to $4769.83, and its total return index soaring from $1642.94 to $10327.83 (8.3% annually) in the same period 2. These figures highlight the overall health and expansion of the broader stock market. Note that for the sake of comparability we suitably chose the S&P500 total return, since Berkshire Hathaway retains its earnings and does not provide a dividend payment to shareholders. This arguably makes Berkshire especially suitable as tax-efficient investment in- and outside the United States ↗.

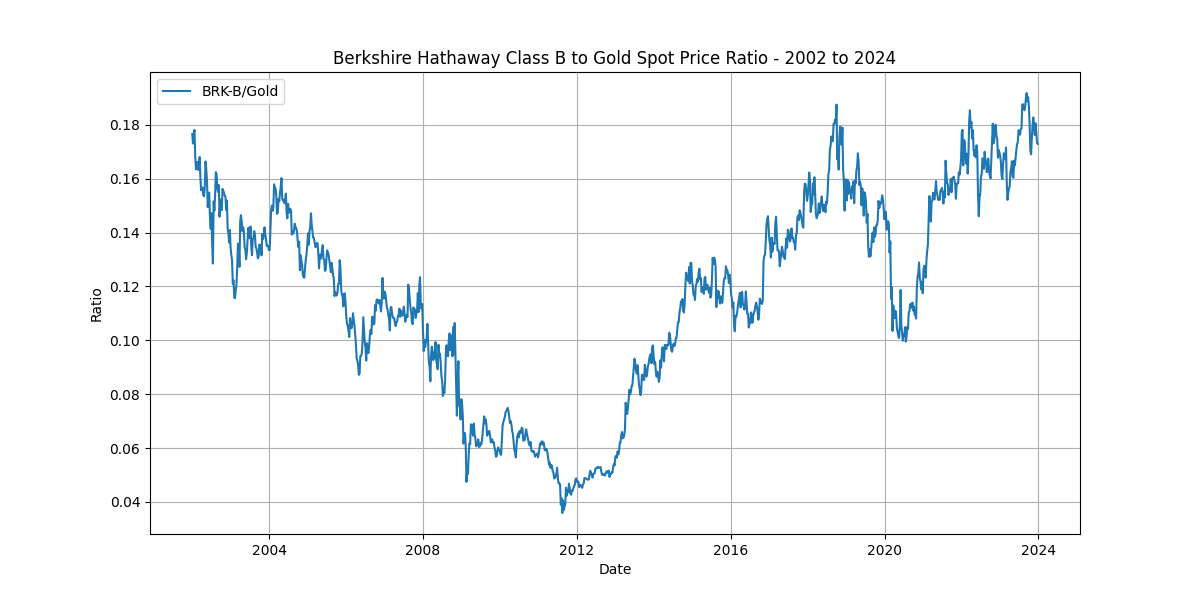

When examining the ratios, the Berkshire Class B to Gold spot ratio fluctuated significantly, particularly in the aftermath of the global financial crisis of 2009-2013, before stabilizing around 0.173 at the end of 2023 2. This value is quite close to the starting value of around 0.177 at the beginning of 2002. Hence, Berkshire Hathaway and gold, at least for the period in question, had a comparable start-to-end performance:

Similarly, to Berkshire Hathaway, the S&P 500 total return to Gold spot ratio saw dramatic changes, starting around 5.90 and settling at 5.01 at the start of 2024, with pronounced long-term dips during and after the financial crisis 2. Interestingly, in the investigated period the S&P500 total return clearly underperformed gold by roughly 20% start-to-end:

These ratios and their fluctuations over time provide insights into investor behavior and confidence in different asset classes during economic cycles. For Berkshire Hathaway shareholders, these metrics underscore the resilience and long-term performance of the company's investment approach, even when compared to gold and the broader market index.

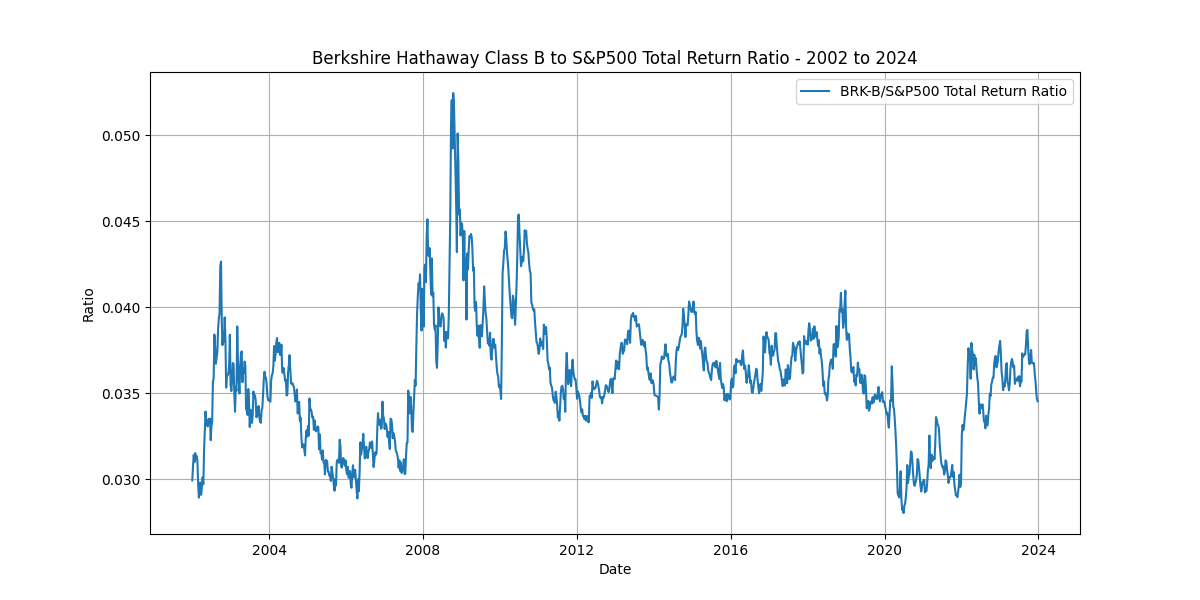

Interestingly, the ratio of Berkshire Hathaway's Class B share compared to the S&P500 total return value remained in a tight band during the period in question. Only at the beginning and for extreme events such as the financial crisis, the ratio seems to deviate from a band between 0.03 and 0.04, see figure below. This implies a strong correlation of the two assets, which is of course no wonder, since Berkshire Hathaway has reached a size for which constantly beating the S&P500 cannot be expected and Berkshire itself is one of the largest holdings in the S&P500 since its inclusion 2010. Warren Buffett himself has advocated investing in low-cost S&P500 index funds many, many times 5.

The outlined comparative analysis reveals a clear picture: while gold has its moments of shine, particularly in times of crisis, Berkshire Hathaway and the broader stock market have offered sustained growth and value creation over the long term ↗. This performance showdown not only highlights the strengths and weaknesses of each investment choice but also reaffirms the wisdom of Buffett's strategy for those who have entrusted their capital to Berkshire Hathaway.

Economic and Political Tides

In the tumultuous sea of global finance, economic and political events have historically steered the course of investment strategies. The financial crisis of 2008 and the COVID-19 pandemic serve as stark reminders of how quickly economic tides can turn ↗. During such times, gold's luster often intensifies, as investors seek refuge in the precious metal, perceived as a 'safe haven' during storms of uncertainty 4.

Monetary policy, with its levers of interest rates and quantitative easing, has a profound influence on investment decisions ↗. Low-interest rates typically diminish the opportunity cost of holding non-yielding assets like gold, making it more attractive. Conversely, when rates rise, the allure of gold often fades in favor of yield-bearing assets.

Political stability, or the lack thereof, can shift gold's appeal dramatically. As a bastion against chaos, gold glimmers brightest when the political landscape is fraught with uncertainty. Its role as a 'safe haven' asset is cemented in times of turmoil, where trust in government-issued currencies wanes, and the demand for gold as 'real money' surges 4.

Inflation is the specter that haunts the value of paper money, making gold's inflation-proof nature a compelling argument for its inclusion in investment portfolios. The precious metal's historical performance during inflationary periods bolsters its reputation as a store of value, a contrast to the fluctuating fortunes of equities.

Geopolitical tensions often precipitate a rush towards gold. The asset's value climbs as investors hedge against market uncertainty, seeking the security that gold has provided throughout history. Currency debasement fears, driven by relentless money printing, further fuel the demand for gold, reinforcing its status as a bulwark against the erosion of wealth 4.

For shareholders of Berkshire Hathaway, these economic and political waves necessitate a careful navigation strategy. While the company, under the stewardship of Warren Buffett, has traditionally eschewed gold in favor of productive assets, the shifting tides of the global economy may prompt a reassessment of investment approaches, ensuring that the portfolio remains robust against the unpredictable currents of the market 1.

The Psychology of Investing

The realm of investing is not solely governed by numbers and logic; it is deeply intertwined with the human psyche. Emotions play a pivotal role, often dictating whether an investor will cling to the safety of gold or venture into the volatile world of equities. The market's pendulum swings between fear and greed, with gold often being the beneficiary of the former 3.

The tangibility of gold exerts a powerful psychological pull. In times of market volatility, the allure of physically holding an asset can provide a sense of control and security that paper assets simply cannot match. This emotional comfort can be a deciding factor for many when choosing to invest in gold over stocks.

Trust in financial leaders also shapes investor behavior. The contrasting views of Warren Buffett and Robert Kiyosaki on gold investment highlight this dynamic. While Buffett's skepticism of gold's productive value influences many to follow his lead, Kiyosaki's advocacy for gold as a hedge against economic uncertainty attracts a different set of followers 3.

Media and expert commentary can amplify or assuage investor fears, shaping perceptions of gold and stocks. The narrative that unfolds in the public discourse often guides the collective mood of the market, swaying investment decisions.

Investors also grapple with their sense of security or insecurity regarding asset types. The non-productive nature of gold, which does not yield dividends or interest, is weighed against the potential for capital appreciation in equities. The long-term versus short-term investment horizons come into play, influencing whether investors prioritize immediate safety or future growth.

A Golden Future or a Gilded Past?

As investors peer into the financial horizon, the role of gold in investment portfolios is a subject of much speculation. Current economic trends, such as the rise of digital currencies and blockchain technology, pose questions about the future of 'safe haven' assets. Will gold maintain its esteemed position, or will new forms of digital gold emerge?

The potential for new technologies and industries to reshape the value landscape is immense. As the world evolves, so too might the relative worth of gold and equities. Environmental, social, and governance (ESG) factors are increasingly influencing investment decisions, potentially affecting the desirability of both asset classes.

Berkshire Hathaway's investment strategy has been a testament to adaptability and foresight. While the company has historically focused on productive assets, the changing market conditions could prompt a strategic pivot, or at least a diversification that acknowledges the evolving role of gold.

The importance of diversification in an investment portfolio cannot be overstated. As the market's history teaches us, neither gold nor equities are infallible. A balanced approach that includes a mix of asset types may offer the best defense against the vagaries of the future.

Hence, while gold's past performance has been a reliable guide for many, the future is unwritten. Investors must weigh historical trends against emerging realities, crafting a portfolio that can withstand the test of time. Whether gold's future is golden or merely gilded, only time will tell.

Conclusion

In our journey through the comparative analysis of gold, Berkshire Hathaway, and the S&P 500 from 2002 to 2024, we've uncovered a tapestry of investment narratives, each with its own set of lessons and implications. The performance showdown has revealed that while Berkshire Hathaway Class B shares have seen a substantial increase from $49.18 to $356.66, gold has also had a remarkable climb from $278.60 to $2062.40 per ounce, and the S&P 500 has grown from $1164.89 to $4769.83, with its total return jumping from $1642.94 to $10327.83 2. These figures paint a picture of a diversified investment landscape where each asset class has had its moments of glory and periods of challenge.

The contrasting philosophies of Warren Buffett and gold advocates like Robert Kiyosaki have been at the forefront of our analysis. Buffett, with a net worth that has fluctuated around US$100 billion to over US$120 billion, has remained steadfast in his belief in productive assets. He has emphasized that gold, with its "two significant shortcomings, being neither of much use nor procreative," is not a suitable investment for those seeking growth 14. On the other hand, Kiyosaki and other gold enthusiasts argue for gold's role as a source of protection in times of crisis and its historical performance as a store of value 13.

Understanding one's own investment goals and risk tolerance is paramount. For some, the stability and potential crisis hedge offered by gold may align with a more conservative investment strategy. For others, the growth potential provided by equities like Berkshire Hathaway and the broader S&P 500 may be more attractive, especially considering Buffett's company outperformed the S&P 500 with total gains of 3,787,464% from 1964 to 2022 3.

Historical data, economic indicators, and personal convictions should all play a role in investment decisions. The ratios of Berkshire Class B to Gold spot and S&P 500 total return to Gold spot have fluctuated significantly over the years, influenced by economic events such as the global financial crisis 2 and geopolitical tensions. These shifts underscore the importance of staying informed and adaptable as market conditions evolve.

For shareholders of Berkshire Hathaway, this analysis serves as a reminder of the company's resilience and the wisdom of its leadership. However, it also highlights the need to consider the role of gold within a diversified portfolio, especially in light of its performance since 2000, which some argue has outpaced both Berkshire Hathaway and the S&P 500 1.

In conclusion, whether you align with Buffett's preference for productive assets or Kiyosaki's advocacy for gold, the key takeaway is the importance of education and staying informed. Markets will continue to fluctuate, and investment strategies should evolve accordingly. As shareholders and investors, we must remain vigilant, flexible, and ever-curious. Let us take this analysis as a call to action to continue deepening our understanding of the markets and to make investment choices that reflect our individual goals, risk profiles, and the economic realities of our times.

References

-

3 Things Warren Buffett Has Said About Gold - investingnews.com ↩↩↩↩↩↩↩↩

-

Yahoo Finance API - finance.yahoo.com, usage of several tickers for research: "BRK-B" for Berkshire Hathaway, "GC=F" for gold, "^GSPC" for the S&P500 and "^SP500TR" for the hypothetical S&P500 total return, hence including dividends. Note: BRK-B is already adjusted for its 50:1 split in 2010 ↗. ↩↩↩↩↩↩↩

-

'I don't need to trust Buffett': Robert Kiyosaki slammed Warren Buffett for his views on gold investing — says the Oracle of Omaha doesn't even invest his own money. So who's right? - finance.yahoo.com ↩↩↩↩↩↩↩

-

Forget gold. Warren Buffett got rich by investing in shares! - www.fool.com.au ↩↩↩↩↩↩↩

-

Warren Buffett once gave a touching tribute to his friend Jack Bogle at Berkshire’s annual meeting - www.cnbc.com ↩