Tags: PCC / Earnings

This fanpage is not officially affiliated with Berkshire Hathaway: Disclaimer

Back in mid-2024, we were already optimistic about Precision Castparts Corp. (PCC) and its strong trajectory for 2024 ↗. Now, with its impressive rebound in full swing, PCC is reaffirming its position as a key industrial pillar within Berkshire Hathaway’s portfolio. In light of recent global developments and PCC’s reliance on its customers' exports, we also take a closer look at the impact of supply chain disruptions and tariffs.

Introduction

In the annals of Berkshire Hathaway’s storied investment history, few deals have resonated with such strategic clarity and long-term vision as the 2015 acquisition of Precision Castparts Corp. (PCC). At $37.2 billion, including debt, this was not only Berkshire’s largest-ever deal—it was a bold statement of faith in the enduring strength of American industry and the global demand for high-performance manufacturing 3. To appreciate the magnitude, consider that the only comparable Berkshire acquisition, the $44 billion purchase of Burlington Northern Santa Fe in 2010, marked a transformative bet on U.S. infrastructure and logistics. With PCC, Warren Buffett signaled a parallel commitment: a belief that the future of aerospace, power generation, and advanced manufacturing would be shaped by companies with deep technical expertise, robust customer relationships, and the capacity to deliver excellence at scale.

Today, nearly a decade later, PCC stands as a linchpin in Berkshire Hathaway’s industrial portfolio. Its complex metal components are not mere cogs in a machine; they are the backbone of modern aerospace, energy, and defense systems. In an era where global supply chains are being reimagined, and geopolitical tensions can shift overnight, PCC’s role as a supplier to giants like Boeing, Airbus, GE Aerospace, Rolls Royce, and Pratt & Whitney has only grown in significance 1. The company’s products power the engines that move people and goods across continents, fortify the infrastructure that keeps the lights on, and underpin the technologies that define national security.

We embark on a comprehensive exploration of PCC’s 2024 performance and its outlook for 2025, offering Berkshire Hathaway shareholders a multidimensional perspective. We will blend financial analysis with insights into industrial trends, supply chain dynamics, and the shifting sands of global commerce. We will also examine the historical roots and technological innovations that have made PCC a beacon of American industrial prowess.

But this is more than a story of balance sheets and earnings reports. It is a narrative of resilience and adaptation—of how a company at the heart of the world’s most demanding sectors navigates the crosscurrents of tariffs, environmental regulation, and raw material scarcity. It is a story of how PCC’s mastery of investment casting, forging, and advanced composites positions it to thrive amid the relentless march of technological progress and the ever-increasing demands of air travel and defense 1.

For Berkshire shareholders, understanding PCC’s journey is to glimpse the future of industrial America—and to appreciate the enduring wisdom of investing in the building blocks of progress.

PCC’s Industrial DNA and Market Position

To understand PCC’s enduring value, one must begin at its roots in Lake Oswego, Oregon—a region steeped in the tradition of American manufacturing. From these origins, Precision Castparts Corp. has evolved into a global powerhouse, renowned for its ability to engineer and produce complex metal components that meet the most exacting standards of modern industry 1.

At the heart of PCC’s success is its diverse and technologically advanced product portfolio, which spans the following core areas:

- Investment Castings and Forgings: PCC is a world leader in the manufacture of precision investment castings and forgings. These components are essential for aircraft engines, industrial gas turbines, aeroderivative engines, airframes, medical implants, armament, unmanned aerial vehicles, and a host of other industrial applications. The company’s mastery of investment casting technology—using ceramic molds to create intricate shapes with fine tolerances and superior surface finishes—gives it a competitive edge that few can match 1.

- Nickel, Titanium, and Cobalt Alloys: PCC produces high-performance alloys in all standard mill forms, including specialty grades for aerospace, chemical processing, oil and gas, pollution control, and other demanding sectors. Its nickel-based alloys are the backbone of forged components and investment castings, while titanium products serve both commercial and military aerospace, as well as energy and medical markets 1.

- Fasteners and Engineered Products: As a leading developer and manufacturer of highly engineered fasteners, fastener systems, aerostructures, and precision components, PCC plays a critical role in ensuring the safety and reliability of aircraft and other complex machines. Its fasteners are trusted by the world’s foremost aerospace OEMs and engine suppliers 1.

- Advanced Composites: PCC is at the forefront of producing high-temperature carbon and ceramic composite components, including ceramic matrix composites for next-generation aerospace engines. These materials are crucial for improving fuel efficiency and reducing emissions in modern aircraft 1.

- Specialty Products and Services: Beyond aerospace and energy, PCC’s expertise extends to general industrial, automotive, heavy truck, farm machinery, mining, shipbuilding, machine tools, appliances, and recreation markets—testament to its adaptability and engineering breadth 1.

PCC’s customer base reads like a who’s who of the global aerospace and power generation industries: Boeing and Airbus rely on its components for their aircraft; GE Aerospace, Rolls Royce, and Pratt & Whitney depend on PCC for the critical parts that power their engines 1. These relationships are not transactional—they are built on decades of trust, technical collaboration, and a relentless focus on quality.

Strategic acquisitions have further strengthened PCC’s market position. A notable example is the purchase of SKF’s metallic rods operation in France and the United States, a move that expanded PCC’s capabilities in supplying specialty metal products to the aerospace sector 6. Such acquisitions are emblematic of PCC’s disciplined approach to portfolio expansion: targeting assets that complement its core competencies and deepen its integration into critical supply chains.

In many ways, PCC is the modern heir to the post-World War II “arsenal of democracy”—a company whose products enable the technologies and systems that define contemporary life and security. Its state-of-the-art facilities, technical expertise, and dedicated workforce are the foundation upon which its global leadership is built. In a world where precision, reliability, and innovation are at a premium, PCC’s industrial DNA is not just a source of competitive advantage—it is the very engine of its enduring success.

Financial Performance: A Story of Resilience and Recovery

The story of Precision Castparts Corp. (PCC) over the past five years is one of remarkable resilience, adaptability, and recovery. The company’s journey through the turbulence of the COVID-19 pandemic and its subsequent rebound offers a compelling narrative of industrial strength and operational excellence—a narrative that every Berkshire Hathaway shareholder should appreciate.

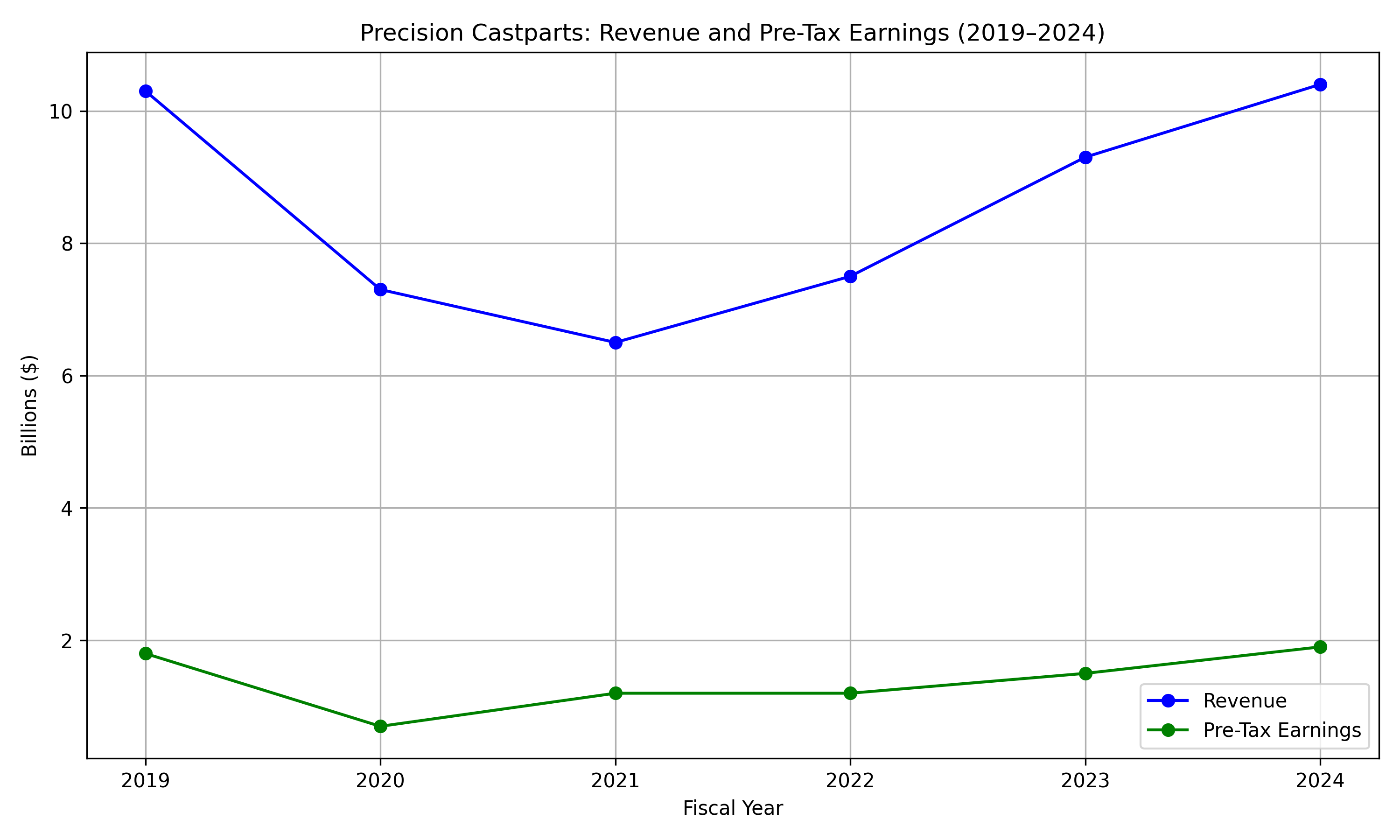

Let us first examine the numbers that tell this story 2:

Note: some numbers were taken from former annual reports and extrapolated based on given changes:

| Fiscal Year | Revenue ($B) | Pre-Tax Earnings ($B) |

|---|---|---|

| 2019 | 10.3 | 1.8 |

| 2020 | 7.3 | 0.7 |

| 2021 | 6.5 | 1.2 |

| 2022 | 7.5 | 1.2 |

| 2023 | 9.3 | 1.5 |

| 2024 | 10.4 | 1.9 |

In short, 2024 was a better year than 2019. Finally!

The COVID-19 pandemic in 2020 delivered an unprecedented blow to the aerospace and industrial sectors, with PCC’s revenue plunging nearly 30% and pre-tax earnings falling by almost two-thirds. Yet, in the years since, PCC has staged a robust comeback, culminating in 2024’s record revenue of $10.4 billion—a 12% increase over the prior year and a return to, and slight surpassing of, pre-pandemic levels 2. Even more impressive, pre-tax earnings soared by 24.4% to $1.9 billion, driven by a potent combination of surging aerospace demand and improved operational efficiencies.

This resurgence is not merely a function of market recovery; it is the result of strategic execution and operational discipline. The key drivers behind PCC’s earnings growth in 2024 can be enumerated as follows:

- Increased Aerospace Sales: The commercial aerospace sector, buoyed by long-term forecasts of strong air travel demand, has been the primary engine of growth. Major OEMs like Boeing and Airbus, as well as engine suppliers such as GE Aerospace, Rolls Royce, and Pratt & Whitney, continue to rely on PCC for mission-critical components 12.

- Improved Manufacturing Efficiency: PCC’s relentless focus on process optimization and technology upgrades has yielded significant productivity gains, further boosting margins 2.

- Supply Chain Recovery: As global supply chains have stabilized post-pandemic, PCC has been able to ramp up production and meet the pent-up demand from its customers 2.

It is also important to contextualize PCC’s financial performance within the broader market landscape. When Berkshire Hathaway acquired PCC in 2015 for $37.2 billion—including debt—it paid a 21% premium over the then-current share price, and nearly 19 times expected earnings, a multiple Warren Buffett himself described as “right there at the top” 3. At the time, this valuation was in line with the S&P 500’s own lofty multiples, reflecting both the high expectations for PCC’s future and the competitive dynamics of the market 3. Today, as PCC’s earnings power returns to and exceeds pre-pandemic levels, the wisdom of that long-term investment becomes increasingly clear.

A critical element of PCC’s financial resilience is its revenue stability, underpinned by long-term agreements with major OEMs. These contracts, often structured as demand schedules, provide a degree of predictability and insulation against short-term market shocks. However, they are not without risk: while outright cancellations are rare, customers occasionally request delivery delays, and the specter of global supply chain disruptions remains ever-present 1.

PCC’s 2024 financial performance stands as a testament to its industrial strength, strategic agility, and ability to deliver on Berkshire Hathaway’s high expectations. The company has not only weathered the storm but emerged stronger, poised for continued growth as the aerospace cycle accelerates.

Navigating Global Headwinds: Supply Chains, Tariffs, and Geopolitics

While PCC’s operational excellence has propelled its financial recovery, the company’s journey has been—and will continue to be—shaped by a complex web of global headwinds. The interplay of supply chain volatility, shifting trade policies, tariffs, and geopolitical uncertainty is reminiscent of past industrial cycles, from the oil shocks of the 1970s to the U.S.-Japan trade tensions of the 1980s. Today’s environment, however, is marked by even greater complexity and interdependence.

Shifting U.S. trade policies and the specter of new tariffs have cast a long shadow over the aerospace supply chain. Recent disruptions—such as the threat of 25% tariffs on aircraft and parts imported from Canada and Mexico, and the ever-evolving status of the USMCA—have injected unprecedented uncertainty into the industry 4. For example, in 2024, Delta Airlines and Airbus faced the prospect of significant delivery delays and cost increases as they navigated the labyrinthine requirements of trade compliance. Delta’s CEO, Ed Bastian, was unequivocal: “We will not be paying tariffs on any aircraft deliveries,” highlighting the high stakes for both airlines and their suppliers 4.

As a critical supplier of investment castings, forgings, fasteners, and high-performance alloys to major aerospace OEMs, PCC is acutely exposed to these global currents. The company’s reliance on specialty metals—nickel, titanium, cobalt, tantalum, hafnium, and molybdenum—sourced from a handful of global locations, further amplifies its vulnerability to political instability, cartel behavior, and inflationary pressures 1. The availability and cost of these raw materials can be influenced as much by world politics and labor relations as by market fundamentals.

Recent examples abound: shipments of RTX engines from Canada to U.S. customers were delayed due to compliance paperwork, while Airbus warned it might prioritize non-U.S. customers if tariffs rendered U.S. deliveries uneconomical 4. These incidents underscore the fragility of global supply chains and the importance of regulatory agility.

Yet, PCC’s competitive advantages—long-standing customer relationships, deep technical expertise, and a reputation for quality—have enabled it to navigate these storms with relative resilience 1. The company’s ability to adapt to evolving regulations, manage complex logistics, and maintain operational continuity has been a key differentiator.

Looking ahead to 2025, the landscape remains fraught with uncertainty. Political cycles, elections, and the ongoing evolution of trade agreements are likely to drive continued volatility in the aerospace and industrial sectors. As history has shown, such periods of turbulence can create both risks and opportunities for those with the scale, expertise, and strategic vision to adapt.

For Berkshire Hathaway shareholders, PCC’s experience navigating these global headwinds is a powerful reminder of the value of industrial resilience and long-term thinking. The company’s ability to weather supply chain shocks, adapt to regulatory shifts, and sustain its leadership in critical markets positions it as a true industrial beacon—not just for Berkshire, but for the entire sector.

Industry Trends and Growth Outlook

The global aerospace and industrial landscape is undergoing a profound transformation, driven by technological innovation, evolving customer demands, and shifting geopolitical realities. For Precision Castparts Corp. (PCC), these trends present both formidable challenges and unprecedented opportunities—especially as the company cements its role as a cornerstone supplier to the world’s leading aircraft and engine manufacturers.

Aircraft Platforms Market: Projected Growth Through 2030

The following table summarizes the projected expansion of the global aircraft platforms market through 2030, highlighting the sector’s robust compound annual growth rate (CAGR) and the forces shaping its trajectory 5:

| Year | Market Size (USD Billion) | CAGR (%) | Key Growth Drivers |

|---|---|---|---|

| 2024 | 235.24 | 4.2 | Fleet modernization, UAV adoption, propulsion tech |

| 2025 | ~245.13 | 4.2 | Defense budgets, AI integration, sustainability |

| 2030 | 301.19 | 4.2 | Urban Air Mobility, Asia-Pacific expansion |

Modernization of aging fleets—across both civil and military aviation—remains a primary catalyst, as airlines and governments seek to replace older aircraft with models that are more efficient, reliable, and environmentally friendly 5. The demand for advanced fighter jets, UAVs (Unmanned Aerial Vehicles), and Urban Air Mobility (UAM) solutions is accelerating, driven by security imperatives, technological leaps in stealth and AI, and the need to address urban congestion.

Defense budgets are on the rise worldwide, as nations respond to emerging security threats and invest in next-generation air defense capabilities. This is particularly evident in North America, Europe, and the rapidly developing Asia-Pacific region, where governments are not only modernizing fleets but also investing in indigenous aerospace ecosystems 5.

Propulsion technology is evolving rapidly. While turbofan engines continue to dominate commercial and military platforms due to their efficiency and reliability, the industry is witnessing a surge of investment in electric and hybrid propulsion systems. This shift is fueled by the dual imperatives of reducing emissions and improving operational economics—a trend that aligns with PCC’s expertise in advanced alloys, ceramic matrix composites, and precision manufacturing for high-performance engines and airframes 1.

The Asia-Pacific region is emerging as a powerhouse, propelled by rising disposable incomes, surging air traffic, and ambitious government investments in both civil and military aviation infrastructure 5. Countries like China and India are not only expanding their fleets but are also nurturing domestic aerospace champions, creating new opportunities for suppliers with the technological depth and scale of PCC.

Yet, the industry’s optimism is tempered by persistent challenges:

- Supply chain instability: Global disruptions, from raw material shortages to logistics bottlenecks, continue to test the resilience of aerospace supply chains 5.

- Regulatory hurdles: Stringent certification requirements and evolving standards for safety and sustainability add complexity and cost.

- High capital costs: The development of new aircraft platforms and propulsion systems demands substantial upfront investment.

- Talent shortages: There is a global deficit of skilled aerospace engineers and technicians, threatening to constrain future growth.

For PCC, these trends are not abstract. The company’s product portfolio—spanning investment castings, forgings, fasteners, and high-performance alloys—directly addresses the needs of next-generation aircraft, UAVs, and power generation systems 1. PCC’s investments in advanced materials and state-of-the-art manufacturing position it to capture share in the most dynamic segments of the market, while its long-standing relationships with OEMs like Boeing, Airbus, and GE Aerospace provide a solid foundation for continued growth 12.

In summary, the aerospace and industrial sectors are poised for sustained expansion through the end of the decade, underpinned by modernization, defense spending, and the relentless pursuit of efficiency and sustainability. PCC’s strategic alignment with these trends bodes well for its future as Berkshire Hathaway’s industrial beacon.

Environmental, Regulatory, and Technological Challenges

As PCC charts its course through a period of robust growth, it must also navigate an increasingly complex environmental and regulatory landscape—a challenge that echoes the transformative waves that reshaped American steel and auto manufacturing in the late 20th century.

Environmental regulations are tightening worldwide, with particular focus on air and water quality, greenhouse gas (GHG) emissions, and climate change mitigation 1. PCC, as a leading producer of high-performance metal components and alloys, is directly affected by these evolving standards. The company is subject to a patchwork of federal, state, and foreign laws governing water discharges, air emissions, waste management, toxic material reduction, and environmental remediation 1. Compliance is not optional—it is an operational imperative that carries both reputational and financial consequences.

The potential for significant capital expenditures looms large. Just as the steel and auto industries were compelled to invest heavily in pollution control and process modernization in the 1970s and 1980s, PCC is likely to face regular—and possibly escalating—outlays to meet new environmental mandates 1. These could include investments in emission abatement technologies, advanced wastewater treatment, and the adoption of cleaner, more efficient manufacturing processes.

PCC’s manufacturing prowess—its expertise in investment casting, forging, and advanced materials—confers a competitive edge but also invites scrutiny. The company’s use of critical raw materials such as nickel, titanium, cobalt, tantalum, hafnium, and molybdenum, often sourced from geopolitically sensitive regions, introduces additional layers of environmental and ethical risk 1. The availability and cost of these metals can be influenced by global politics, labor relations, and even the actions of private or governmental cartels.

Environmental impact tracking and reporting are becoming central to customer relationships, especially with major aerospace OEMs like Boeing and Airbus, who face their own ambitious sustainability targets. PCC’s ability to demonstrate responsible stewardship of resources, transparent emissions reporting, and progress toward decarbonization will increasingly influence its standing with these critical partners 1.

Technology is both a challenge and a solution. PCC is investing in cleaner processes, digital manufacturing, and the development of advanced composites—such as ceramic matrix composites—for lighter, more fuel-efficient aircraft 1. These innovations not only reduce environmental impact but also enhance product performance, aligning with the industry’s twin goals of sustainability and operational excellence.

To distill PCC’s key environmental risk factors:

- Raw material sourcing: Reliance on metals from limited global sources, subject to market and political volatility. ↗

- Emissions: Air and water emissions from manufacturing processes, subject to tightening regulatory limits.

- Waste management: Safe handling and disposal of industrial byproducts and hazardous materials.

- Regulatory compliance: Ongoing need to adapt to evolving laws and standards, both domestically and internationally.

The global shift toward ESG (Environmental, Social, Governance) investing adds another dimension. Investors are increasingly scrutinizing the environmental performance of industrial companies, influencing capital flows and even customer procurement decisions. For PCC, proactive engagement with ESG principles is not just about regulatory compliance—it is about securing its license to operate and thrive in a rapidly changing world.

While the environmental and regulatory headwinds are formidable, PCC’s history of innovation, technical expertise, and commitment to operational excellence position it to turn these challenges into sources of long-term competitive advantage. The company’s journey mirrors the broader industrial evolution: those who adapt, invest, and lead will define the next era of sustainable growth.

Conclusion: The Road Ahead for PCC and Berkshire Shareholders

Precision Castparts Corp.’s remarkable recovery and record-breaking performance in 2024 underscore its indispensable role within Berkshire Hathaway’s industrial portfolio ↗ ↗. With revenues climbing to $10.4 billion and pre-tax earnings surging 24.4% to $1.9 billion, PCC has not only rebounded from the unprecedented disruptions of the pandemic but has reaffirmed its strategic value as a cornerstone of Berkshire’s long-term industrial vision 2. This robust financial resurgence reflects more than cyclical recovery—it is a testament to PCC’s operational discipline, technological leadership, and its ability to meet soaring aerospace and power generation demand with precision and scale.

The company’s resilience amid global supply chain shocks, shifting trade policies, and evolving environmental regulations further distinguishes it as a beacon of industrial strength. Navigating the complexities of tariffs, geopolitical uncertainty, and raw material volatility—challenges that echo the historic trade and regulatory upheavals faced by American industry in previous decades—PCC has demonstrated an exceptional capacity to adapt and innovate 14. Its long-standing customer relationships and deep technical expertise have provided a vital buffer against external shocks, enabling continuity and growth where many competitors face disruption.

Looking ahead, the long-term growth prospects for aerospace and power generation remain compelling. Industry forecasts project a sustained expansion of the global aircraft platforms market to over $300 billion by 2030, driven by fleet modernization, defense spending, and the emergence of next-generation propulsion technologies 5. PCC’s comprehensive product portfolio—including advanced investment castings, high-performance alloys, and cutting-edge composites—positions it uniquely to capture value from these trends. Its alignment with evolving customer needs, from commercial airliners to UAVs and urban air mobility solutions, ensures that PCC will remain integral to the future of aerospace innovation and energy infrastructure.

To maintain and enhance this competitive advantage, continued investment in technology, manufacturing efficiency, and environmental compliance is paramount. PCC’s commitment to developing cleaner processes, adopting digital manufacturing, and advancing sustainable materials reflects a forward-looking approach that balances operational excellence with regulatory responsibility 1. As environmental standards tighten and ESG considerations gain prominence, PCC’s proactive engagement will not only mitigate risks but also strengthen its standing with customers and investors alike.

Historically, PCC’s journey mirrors the transformative industrial epochs that reshaped American manufacturing—from the post-World War II “arsenal of democracy” to the modernization waves of the late 20th century. In each era, adaptability, innovation, and strategic foresight proved decisive. Today, PCC stands at a similar crossroads, where the convergence of technology, trade dynamics, and sustainability imperatives will define the next chapter of industrial leadership. Its ability to navigate these forces with agility and vision will be critical to sustaining growth and delivering shareholder value.

For Berkshire Hathaway shareholders, PCC is far more than a financial asset—it is a bellwether of American and global industry, embodying the enduring wisdom of investing in the foundational technologies and materials that power modern life. As we look toward 2025, the outlook is cautiously optimistic: external challenges persist, but PCC’s relentless pursuit of excellence, combined with its strategic positioning, offers a clear pathway to continued success.

References

-

2024 Annual Report - www.berkshirehathaway.com ↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩↩

-

2024 Annual Report - Industrial Products - www.berkshirehathaway.com ↩↩↩↩↩↩↩

-

Warren Buffett Bucks Trends With Precision Castparts Acquisition (Published 2015) - www.nytimes.com ↩↩↩

-

Trump's tariff confusion could leave aircraft deliveries in limbo - www.reuters.com ↩↩↩↩

-

Aircraft Platforms Market Research Report 2025: Transport Aircraft, Special Missions Aircraft, UAVs, Fuel Cell, SAF-Based, Battery-Powered, Turbofan, Turfoprop, Turbojet, Electric - Forecast to 2030 - finance.yahoo.com ↩↩↩↩↩↩

-

AB SKF : SKF divests metallic rods operation to Precision Castparts Corp. - www.marketscreener.com ↩